| CANVAS OF PLANS & DRAWINGS |

INTERIOR & DÉCOR, but with a twist |

| HOTELS & RESTAURANTS, beyond mainstream |

Notes on ART |

| Into big AFFAIRS | INSIDERS |

| GLIMPSES | |

Keywords:

Exploring the trends of luxury to be understood not as ostentation, but as an innovative approach to well-being and a ‘total experience’. This is the direction taken by the new season of Talk for a Change, the series by Medelhan Production which, starting this year, takes on the unprecedented form of podcasts as well as an increasing focus on the expanding world of luxury hospitality. For the first episode of 2024, we find ourselves in Rome, a city that can serve as a valid barometer for assessing the state of the art of hospitality. Indeed, among the structures present in its territory are the Bulgari Hotel, named the best 5-star hotel in 2023, and the Six Senses, which ranks seventh. Furthermore, according to data from Luxury Travel Intelligence, Rome has also two representatives in the top 15 most interesting properties worldwide.

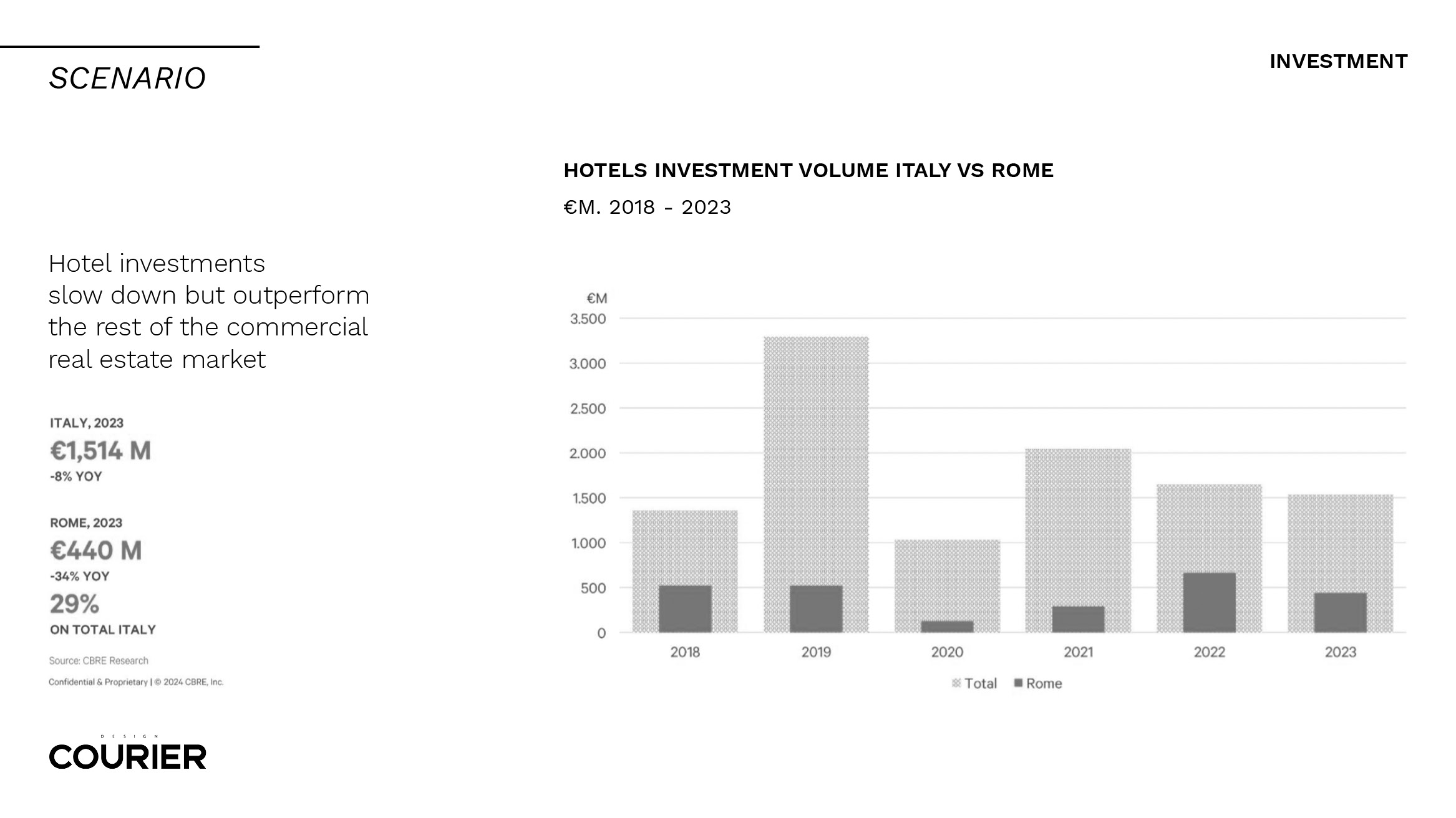

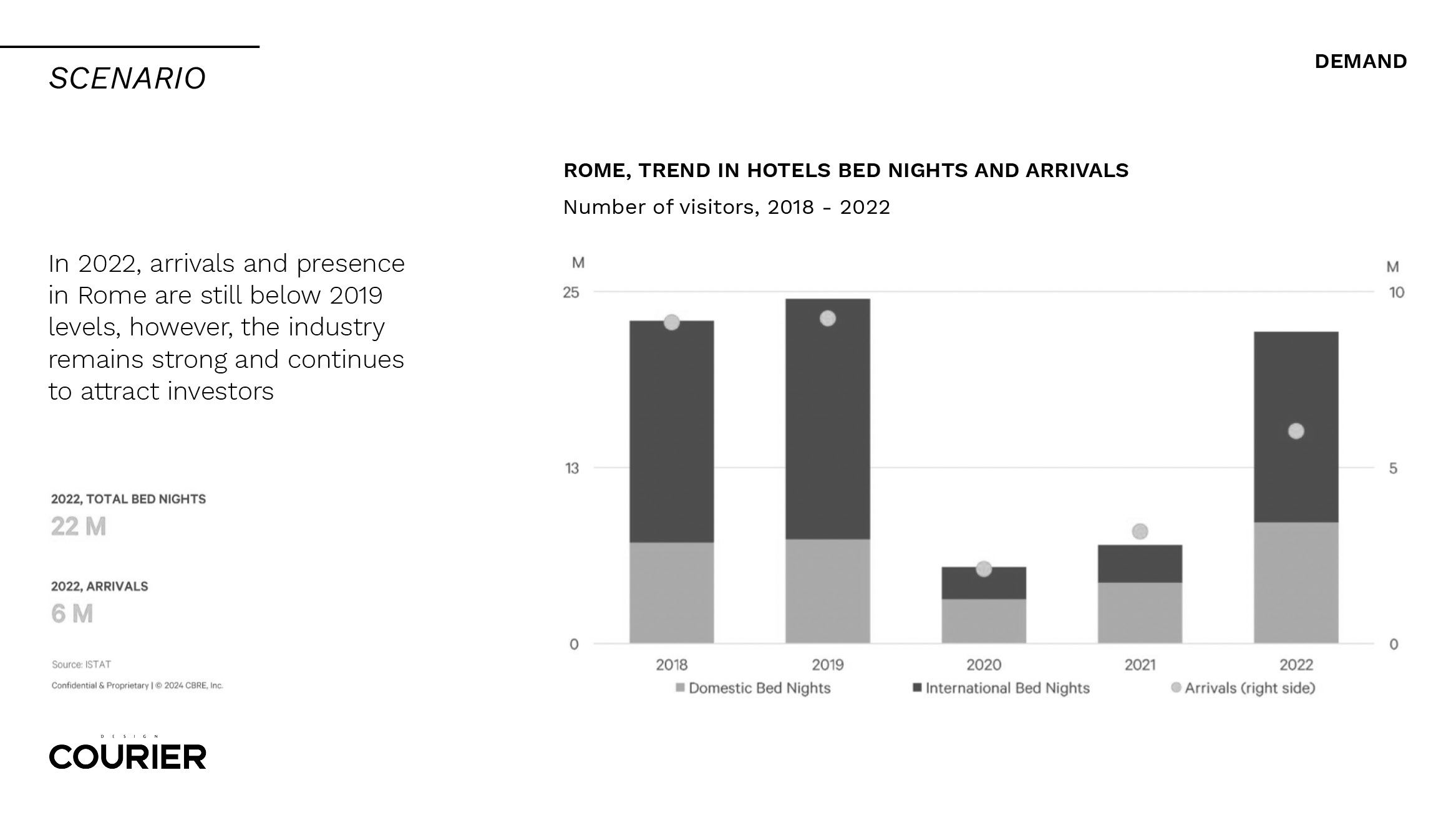

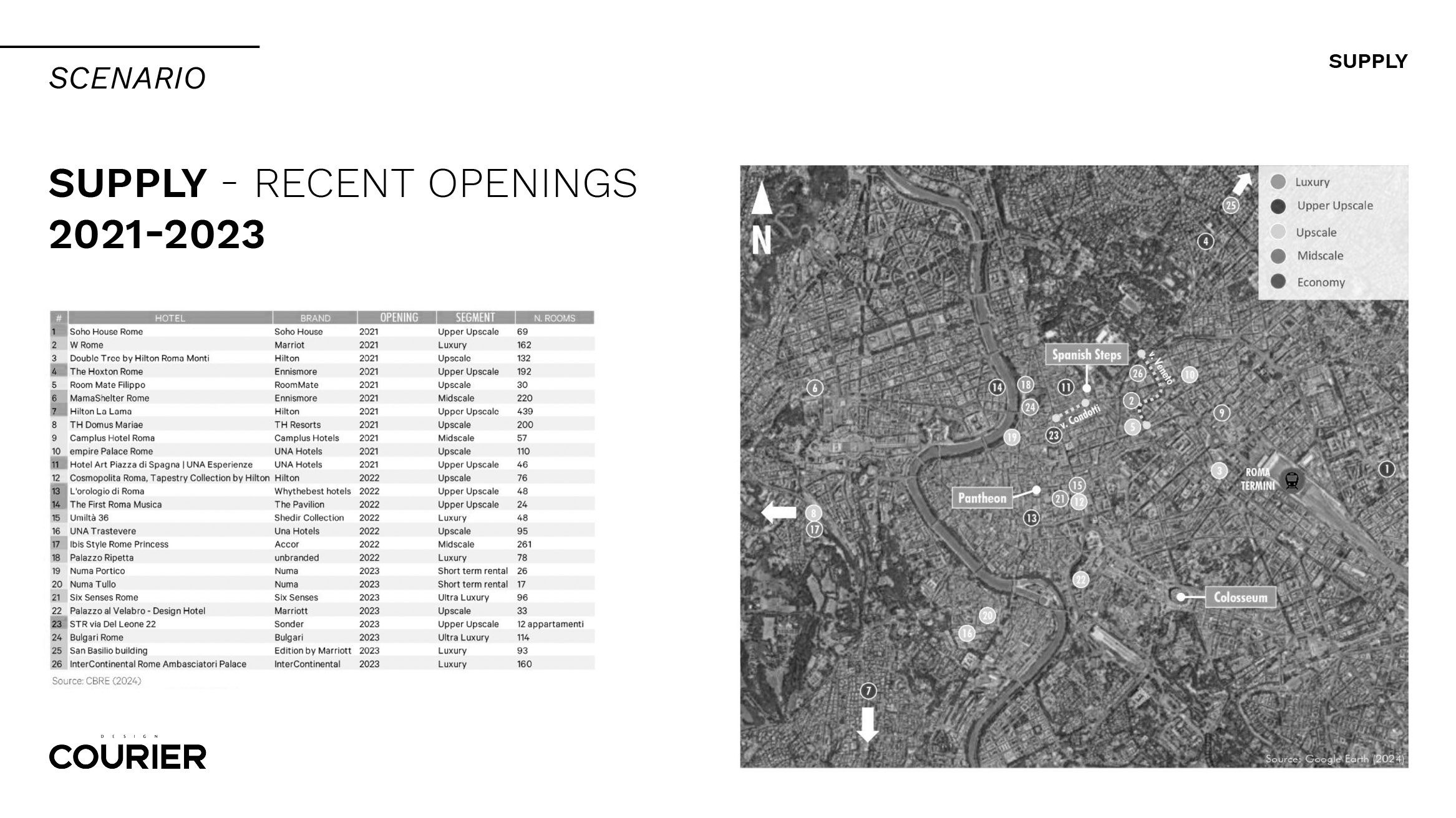

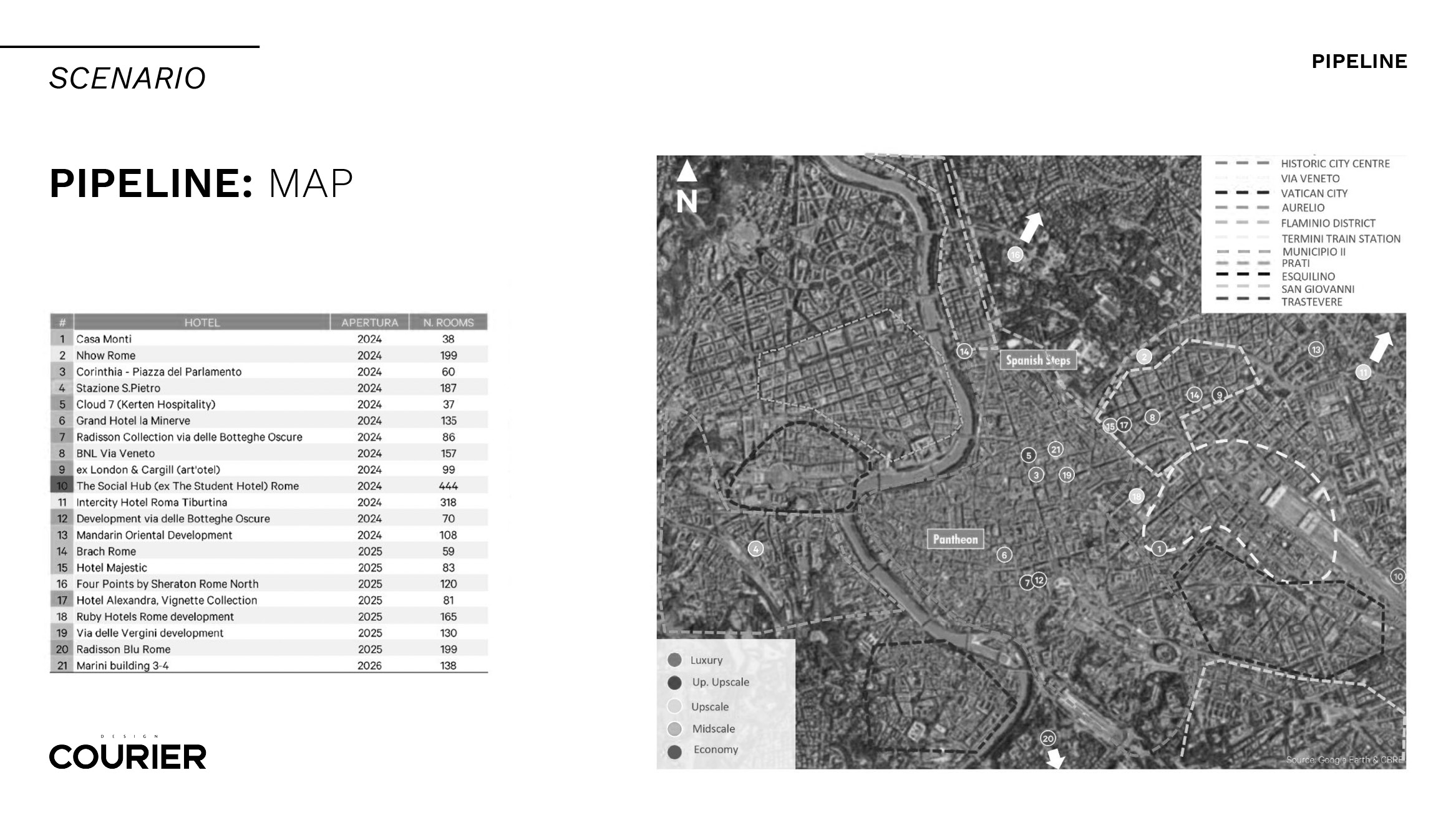

Another key factor in framing the phenomenon of the Eternal City is its pipeline of new openings – a trend that in the 2018-2022 quinquennium brought fourty new 5-star structures and a strong growth prospect for the subsequent quinquennium. Expanding to the broader Italian context, among the data at our disposal is the return of foreign tourists to Italy, with a presence of over 445 million people in 2023 – a figure for the first time higher than in 2019, marking an 8.1% growth over 2022. To unfold this complex framework of data and numbers in a spectrum of scenario, we refer to the analysis carried out for Talk for a Change by Giordano Nicoletti, Head of Hotel Operator Selection Europe & Consultancy at CBRE and partner of Medelhan.

The hotel pipeline in Rome is increasingly shifting towards the high-end segment, with a dense concentration in downtown locations. Although Rome is much more than just its city center, approximately 80% of the openings are focused on the central area. This creates a disparity between the supply in neighborhoods such as the Colosseum and the Vatican, and decentralized areas that would deserve a greater number of high-positioned chain hotels.

Nonetheless, what has been seen so far still offers a positive perspective on Rome’s market, whose performance in terms of RevPAR – the ratio between a hotel’s occupancy rate and the average room rate – stands at €170, therefore higher than Milan. On the other hand, tourist flows must be considered: while Rome accommodates 26 million hotel tourists, Milan has 10 million. Hence, why is Milan able to reduce the gap between tourist flows and RevPAR? It is because the hotel quality offered by Milan is superior to that of Rome, especially in the high-end market segments. If we instead analyze the immediately lower segment, the four-star category, we notice a strong polarization between the two cities. This means that there are great opportunities for performance in the intermediate segments.

Finally, if we compare the RevPAR of the top six hotels in Rome, Paris, and London, we can see that Rome’s RevPAR ranks just below Paris and above London. This indicates that, despite having fewer chain hotels compared to London, Rome maintains high competitiveness. Thus, numbers show that, with the progressive improvement of its offerings, Rome can certainly become a benchmark for high-level hospitality in Europe.