| CANVAS OF PLANS & DRAWINGS |

INTERIOR & DÉCOR, but with a twist |

| HOTELS & RESTAURANTS, beyond mainstream |

Notes on ART |

| Into big AFFAIRS | INSIDERS |

| GLIMPSES | |

Keywords:

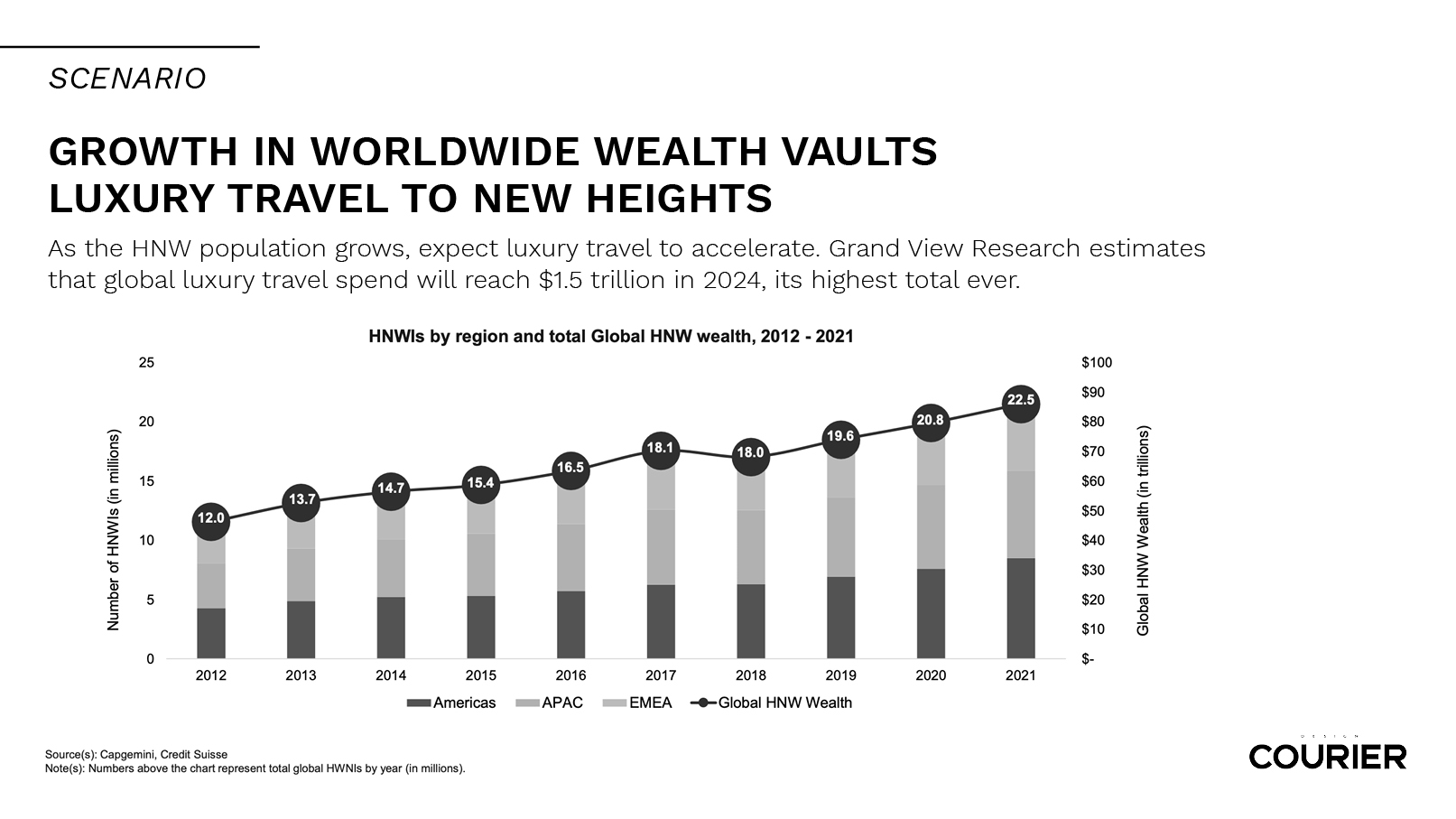

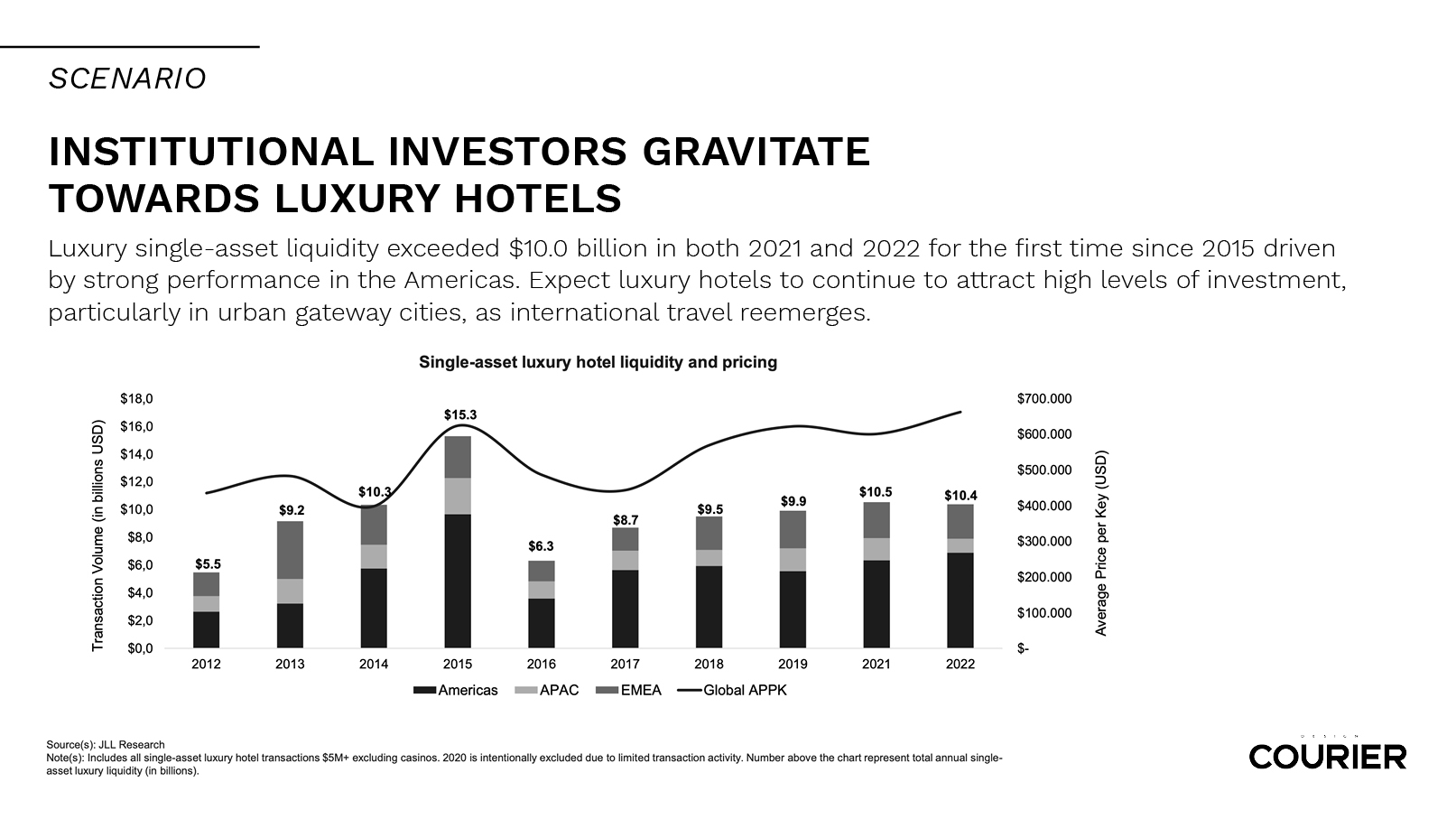

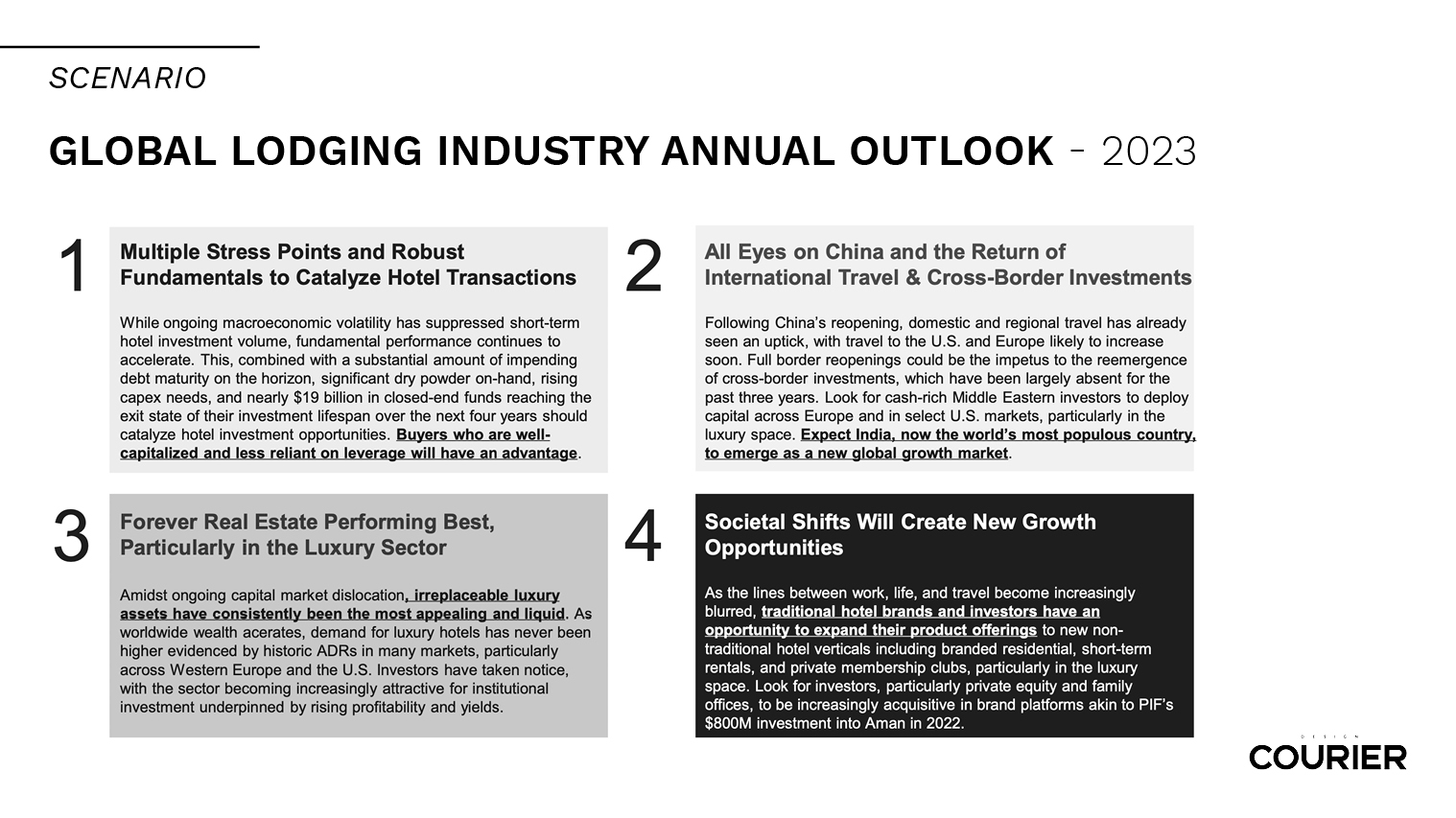

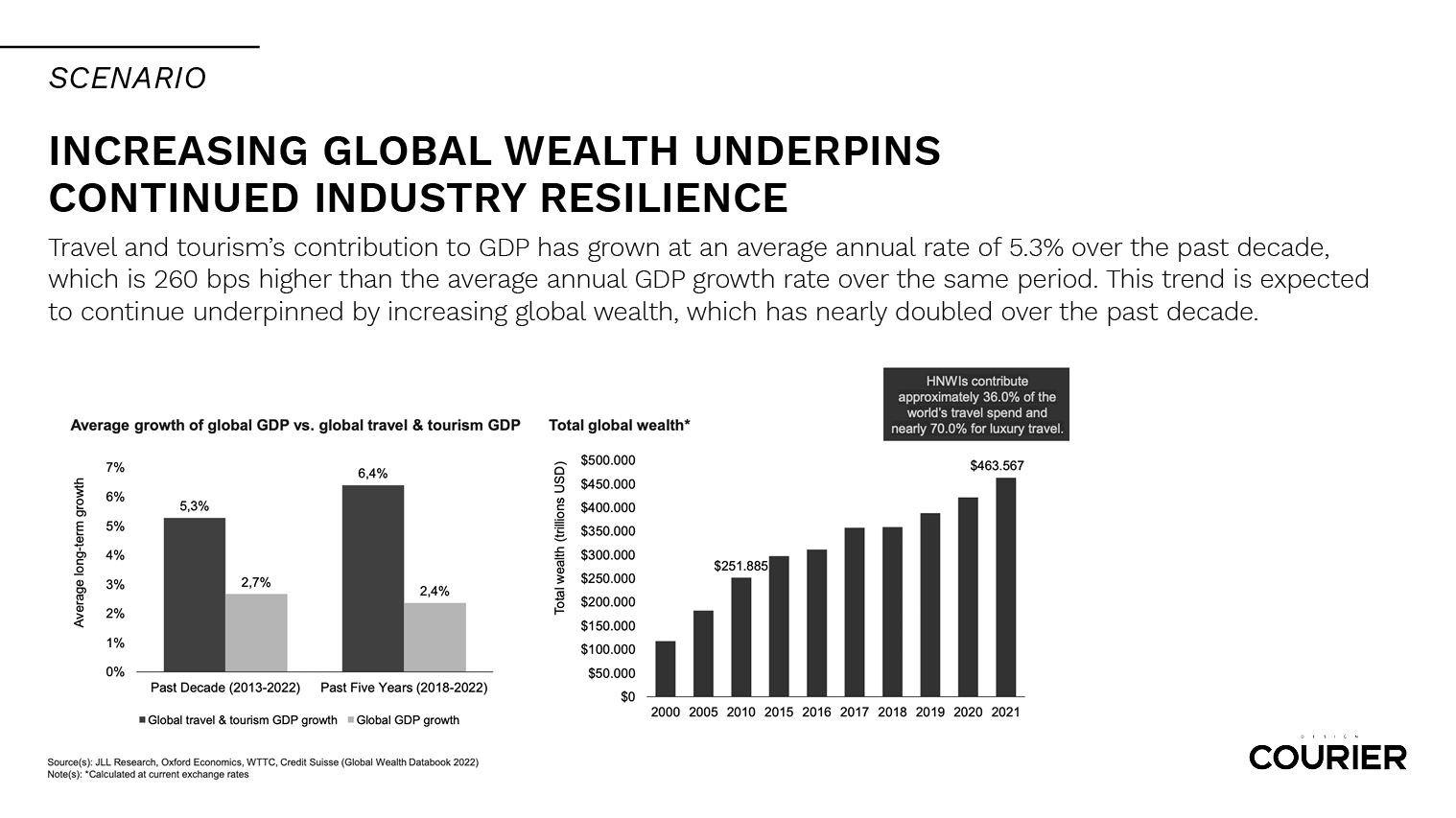

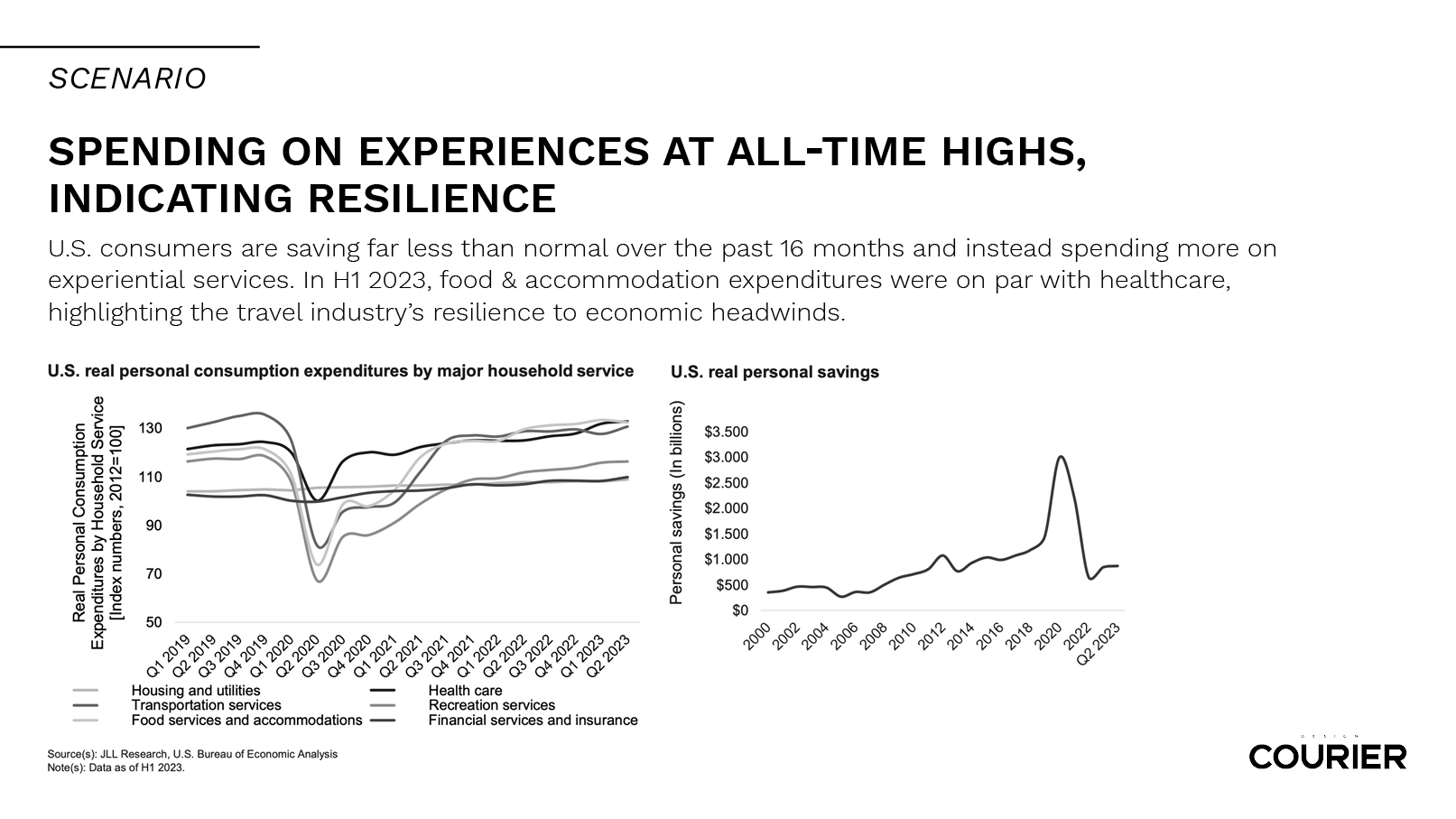

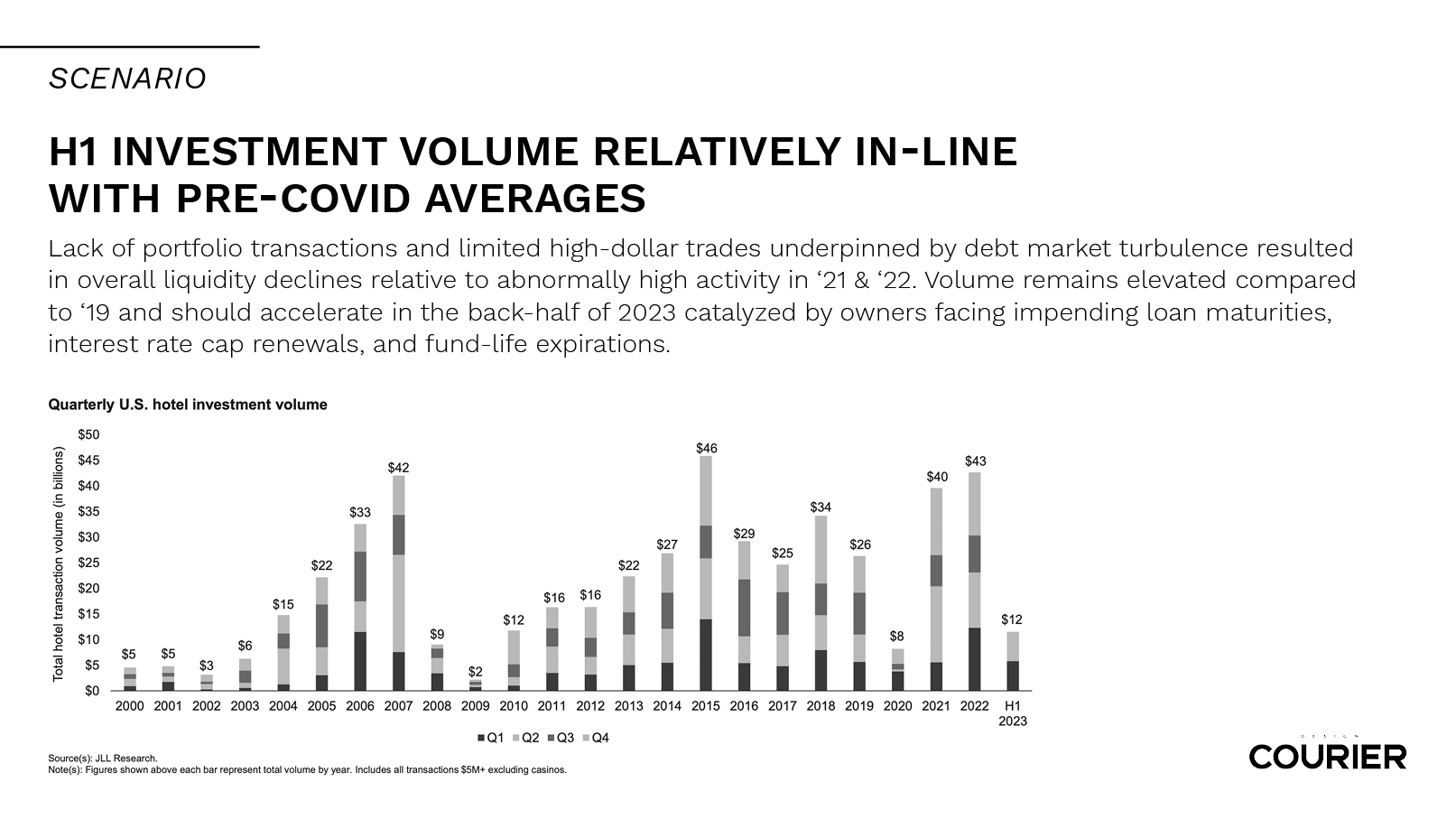

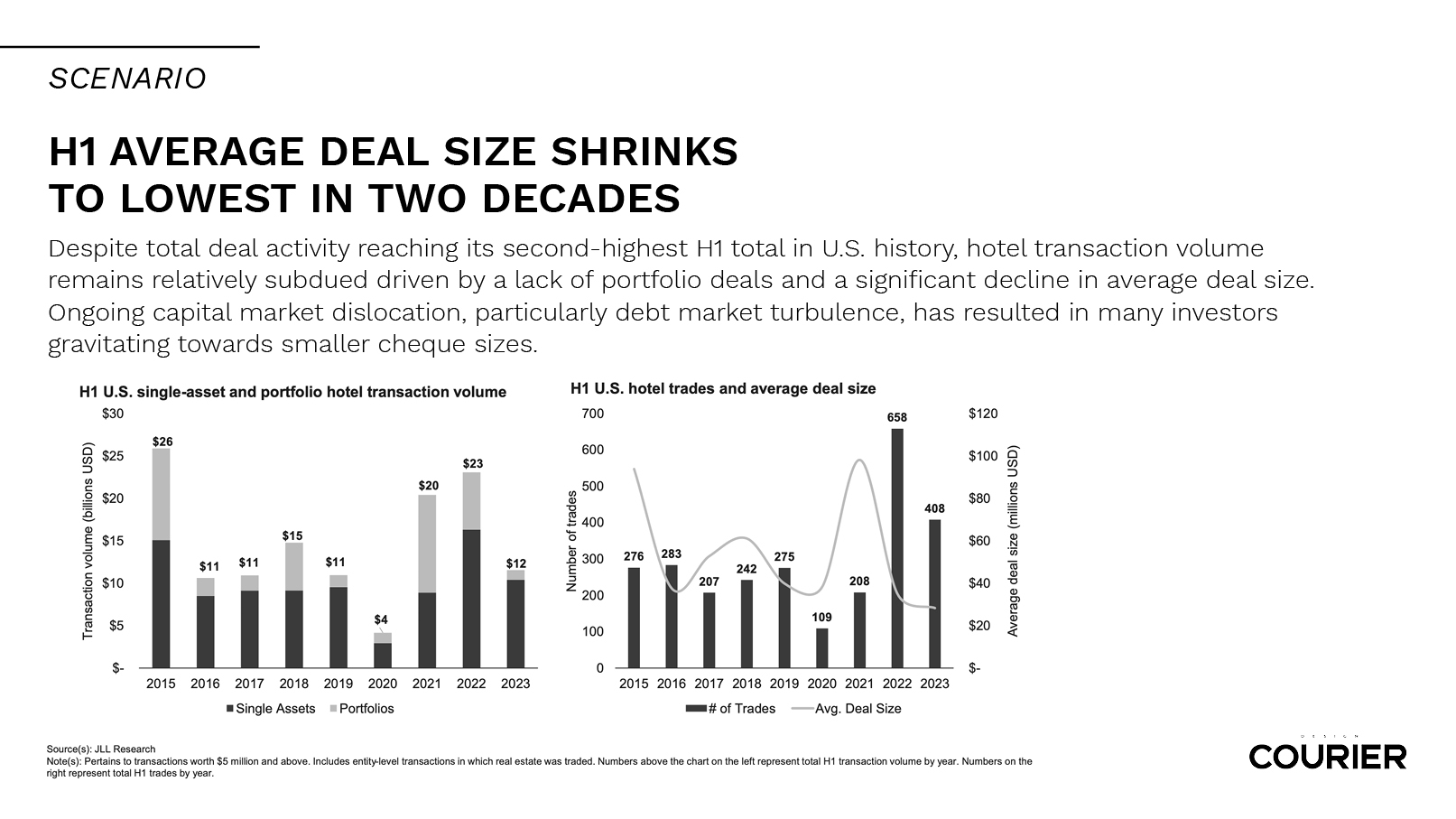

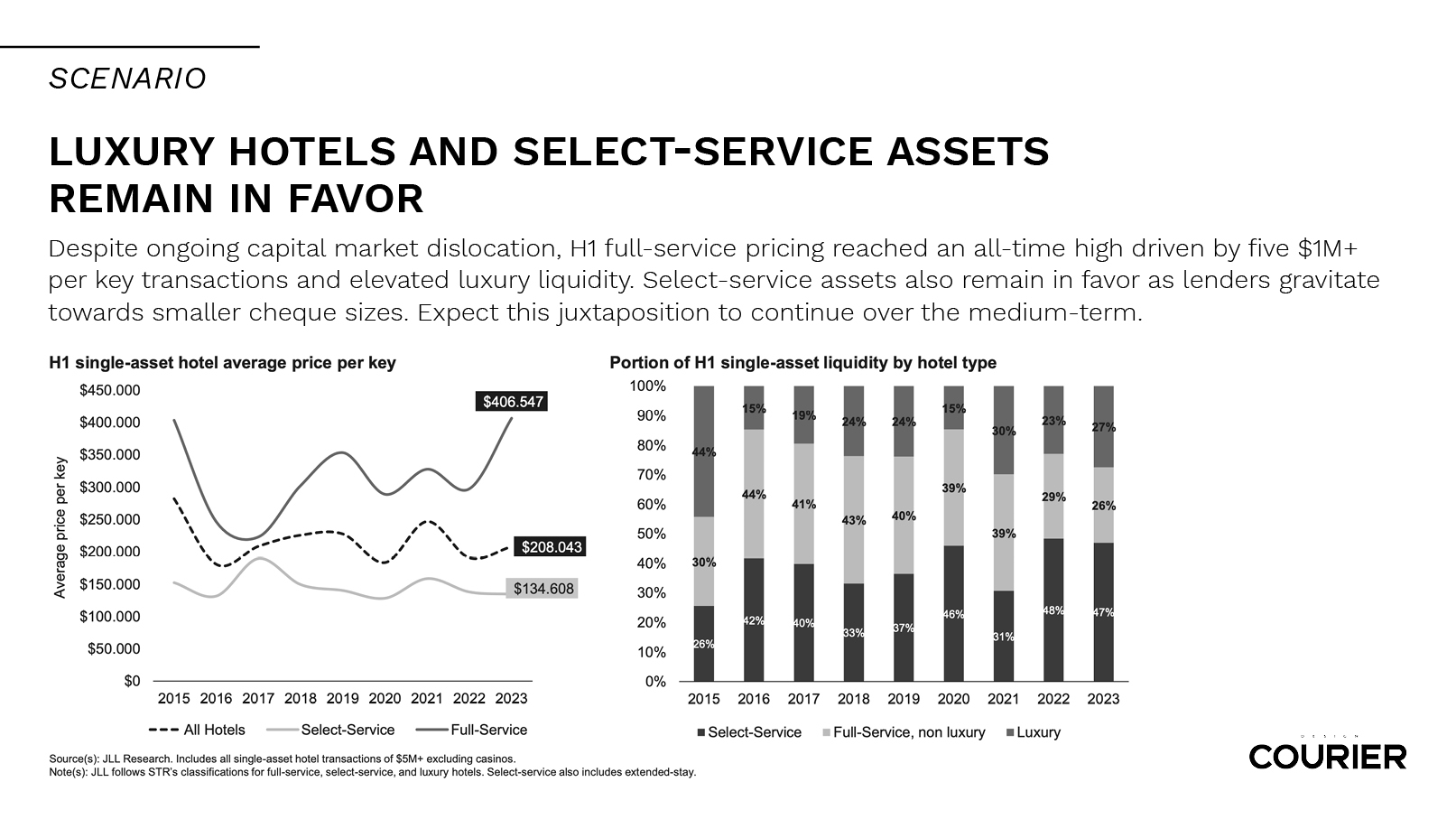

On the whole, the luxury and select service assets remain in demand. Select service or hotels without food and beverage have a smaller ticket size – under 30 million – and investors tend to buy a number of them to have a more diversified portfolio, instead of favoring a 200 or 300 million asset. Since high net worth individuals have made more money after 2020 than they ever have, investors are now also buying long term assets. When we get into prices, things might appear a little “gloom and doom”, but the fact is that, looking worldwide, luxury travels are at all new heights. Grand View Research estimates that global spending on luxury travel will reach $1.5 trillion in 2024, its highest total ever.