| CANVAS OF PLANS & DRAWINGS |

INTERIOR & DÉCOR, but with a twist |

| HOTELS & RESTAURANTS, beyond mainstream |

Notes on ART |

| Into big AFFAIRS | INSIDERS |

| GLIMPSES | |

Keywords:

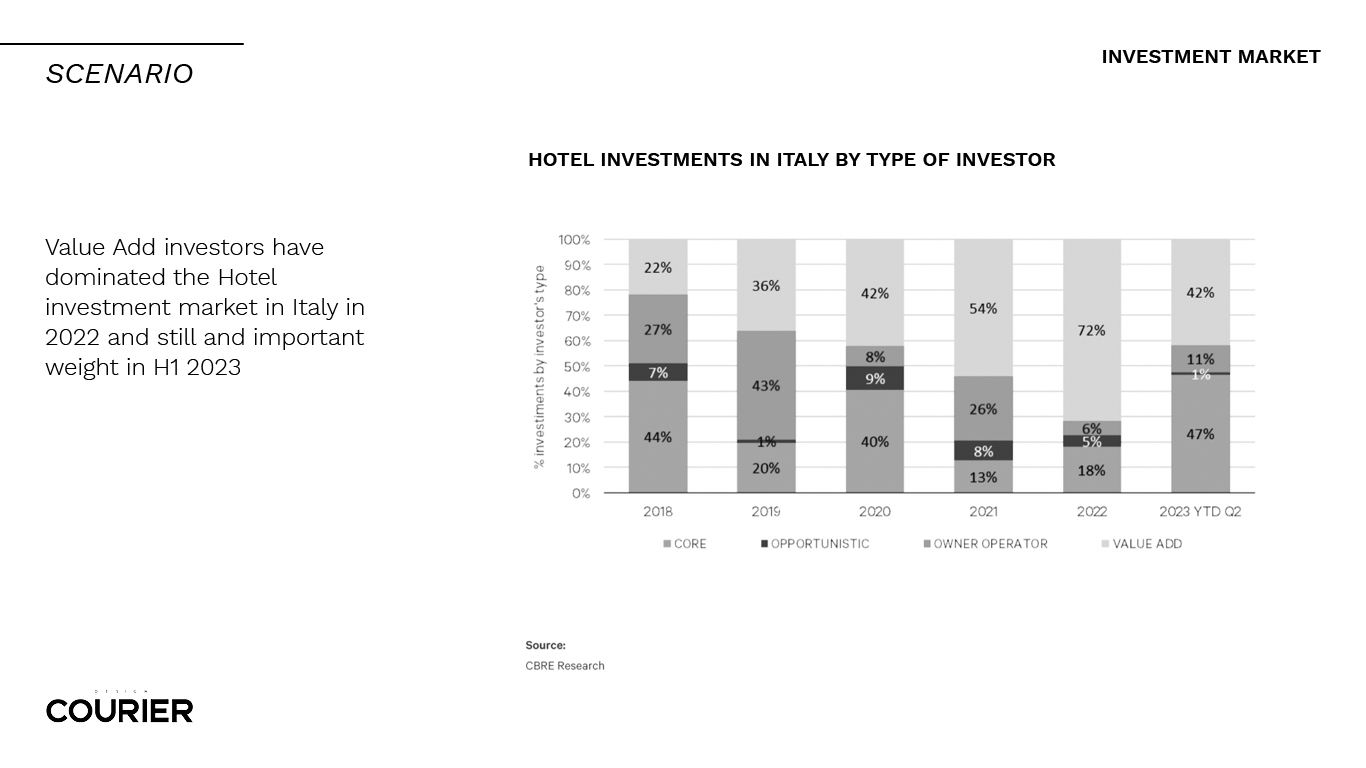

One more interesting data concerns the type of investor or investment. In particular, the dominance of value-add transactions has grown over the past five years. In fact, existing unbranded hotels are bought and, with new management and a solid label, they are resold after a few years. This discourse also pertains to conversions, which on the Italian territory have been numerous, especially in Rome. For this semester there was also a small recovery on core investments, that is on the purchase of income goods, already provided with a tenant and a long-term contract. This includes family offices and student hotels, the only cash buyers who today buy full equity.

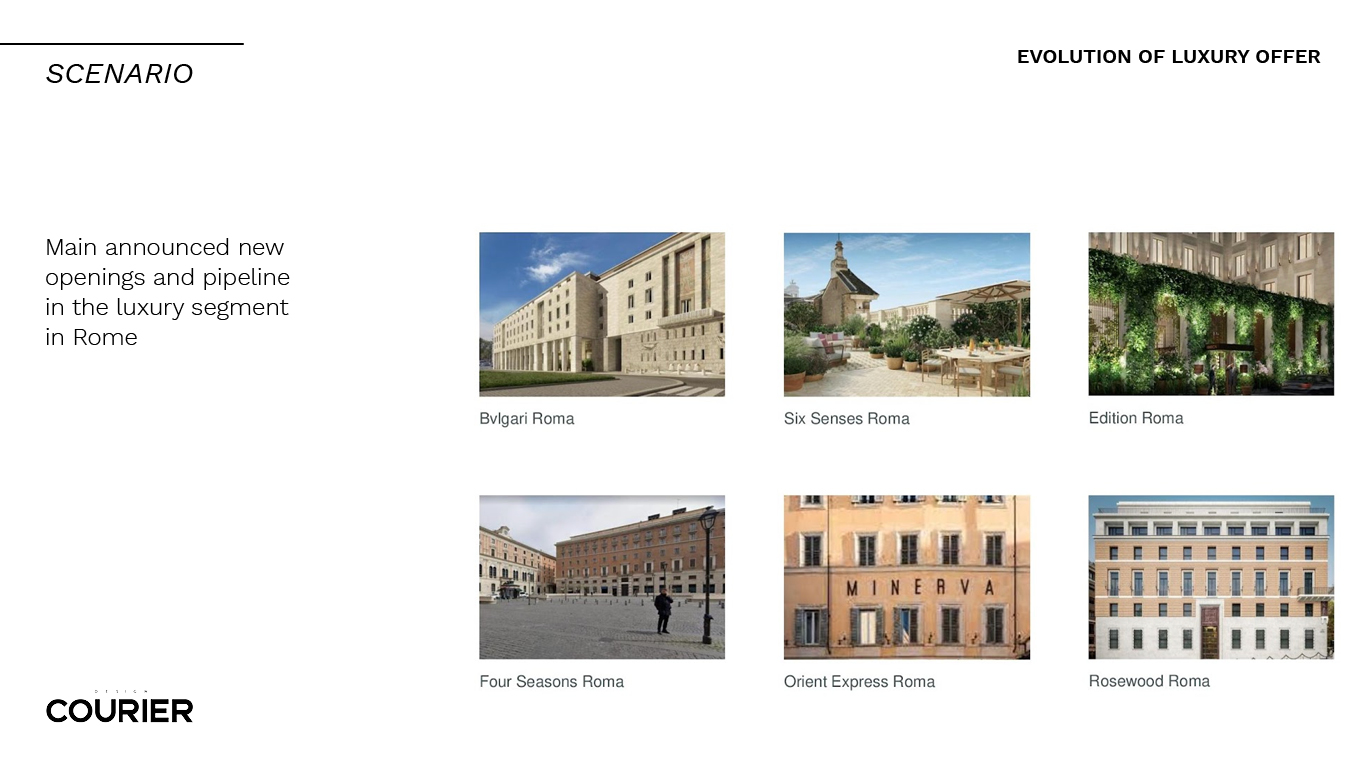

Observing the evolution of the offer in terms of luxury, it emerges that in the last four years Rome has had a remarkable activity. We can actually affirm that it is the most active market in Italy in terms of new openings. Among the many examples that can be mentioned, the Rosewood hotel, former headquarters of the BNL bank, is still today the most expensive single asset ever transacted in Italy. Historically, in Italy’s capital city there has always been a branding gap, which has been bridged only in the last few years. Among others, the absence of a Four Season clashed with the influx of Americans in Rome. Finally, turning to the more general panorama, we see that many resorts are opening, which is a good sign as it is a valued segment in transactions. Among the hottest markets we must cite Lake Como, Sardinia and Cortina, this latter especially in view of 2026. There are also new openings in Venice, Milan and Florence, where the luxury offer is becoming more and more complete.