| CANVAS OF PLANS & DRAWINGS |

INTERIOR & DÉCOR, but with a twist |

| HOTELS & RESTAURANTS, beyond mainstream |

Notes on ART |

| Into big AFFAIRS | INSIDERS |

| GLIMPSES | |

Keywords:

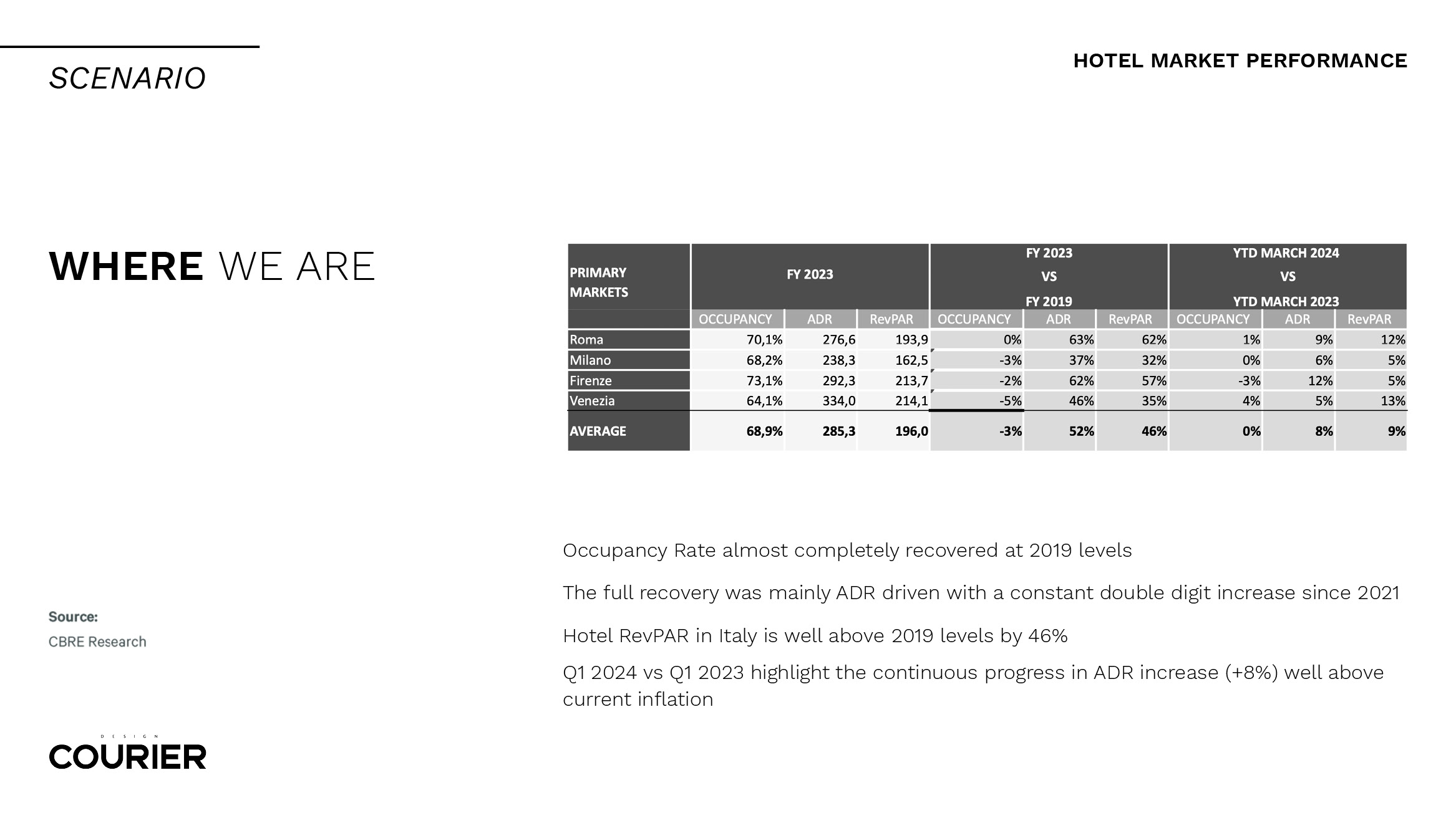

Created to explore the latest luxury trends dominating the capitals of design and architecture, the Talks For a Change series by Medelhan Production continues an innovative approach to well-being and to the value of a total experience. In the latest episode, held on the Italian stage of Milan, the focus was on so-called upscale hotels. These high-end accommodations offer luxurious services and superior quality in their facilities and guest experiences, whilst not reaching the highest luxury tier of luxury hotels. If the former are placed in a price range between 200 and 500 euros per night, the latter go well beyond: just think of the branded hotel Louis Vuitton, in Paris, which, still under development, is expected to cost 50 thousand euros per night. Domenico Basanisi, Head of Hotels Investment Properties at CBRE Italy, discussed these nuances of positioning within the hotel segment, and the most effective strategies for standing out in such a complex network.

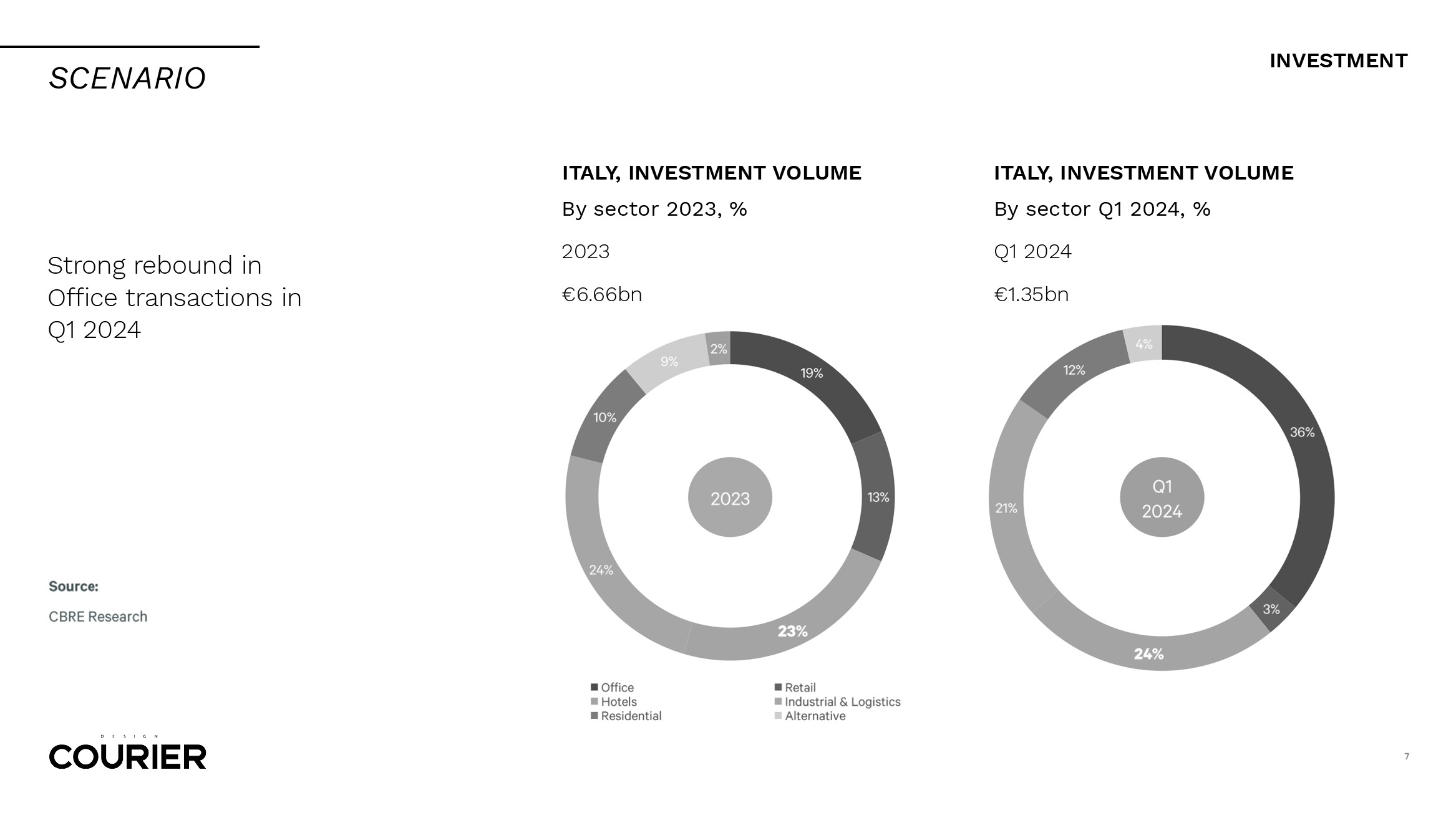

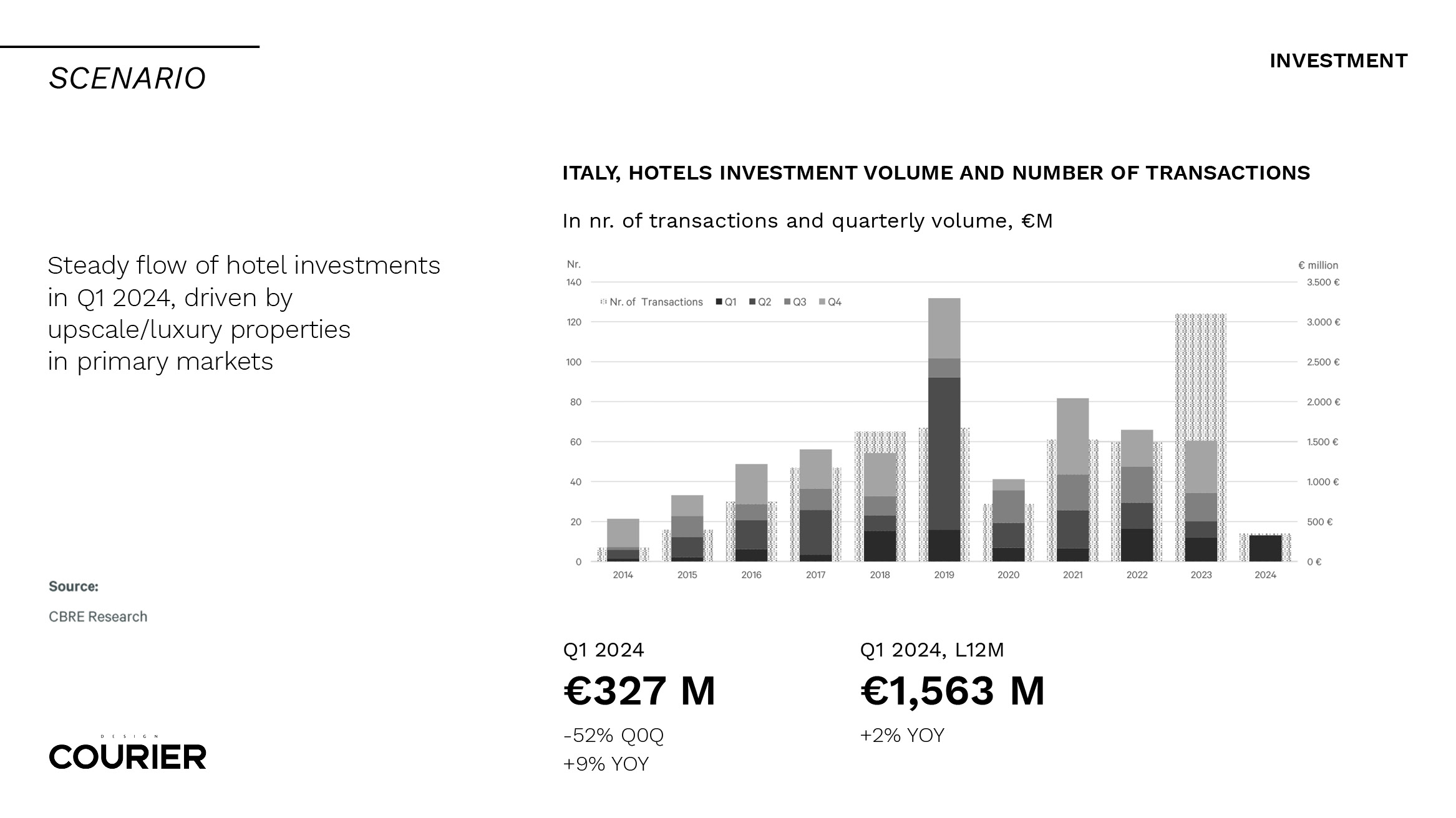

What is happening in commercial real estate in Italy? Looking at the sector more broadly, including not only the hotel segment but also offices, retail, logistics, and residential, the trend seems to change. The Investment Market is still declining: 2023 closed at around 7 billion, compared to 12 billion in 2022. There has been a general slowdown in various asset classes, particularly offices and retail. However, logistics, alongside hospitality, has held steady year-on-year. The fact that these last two are weighted equally, especially considering that logistics has been the leading asset class in recent years, is significant: they account for half of the Commercial Real Estate transactions in the past year. For the hotel segment, the outlook for 2024 suggests a significant year in terms of transaction volume, supported by an already important pipeline, potentially reaching close to 2 billion, aligning with 2021 figures.

Why are capitals currently in a wait-and-see phase? In Italy, BTP yields, along with the number of transactions, have risen significantly over the past eighteen months. Consequently, as the risk-free investment parameter, all Real Estate investments have increased substantially, particularly offices, which are now at a historic peak (from 3.2 in 2023 to 4.65 net in 2024), and hospitality (from 4.5 in 2023 to 5.0 net in 2024). This means the expected return on Real Estate investments has risen, creating a strong imbalance between core capitals and sellers, who often face repricing of their assets bought previously with very low yields, especially if they had fixed leases. Technically, the object is worth less because it needs to yield more to be liquid, and there is a basic imbalance between sellers and buyers. This is the fundamental cause of the stagnation in the investor market.

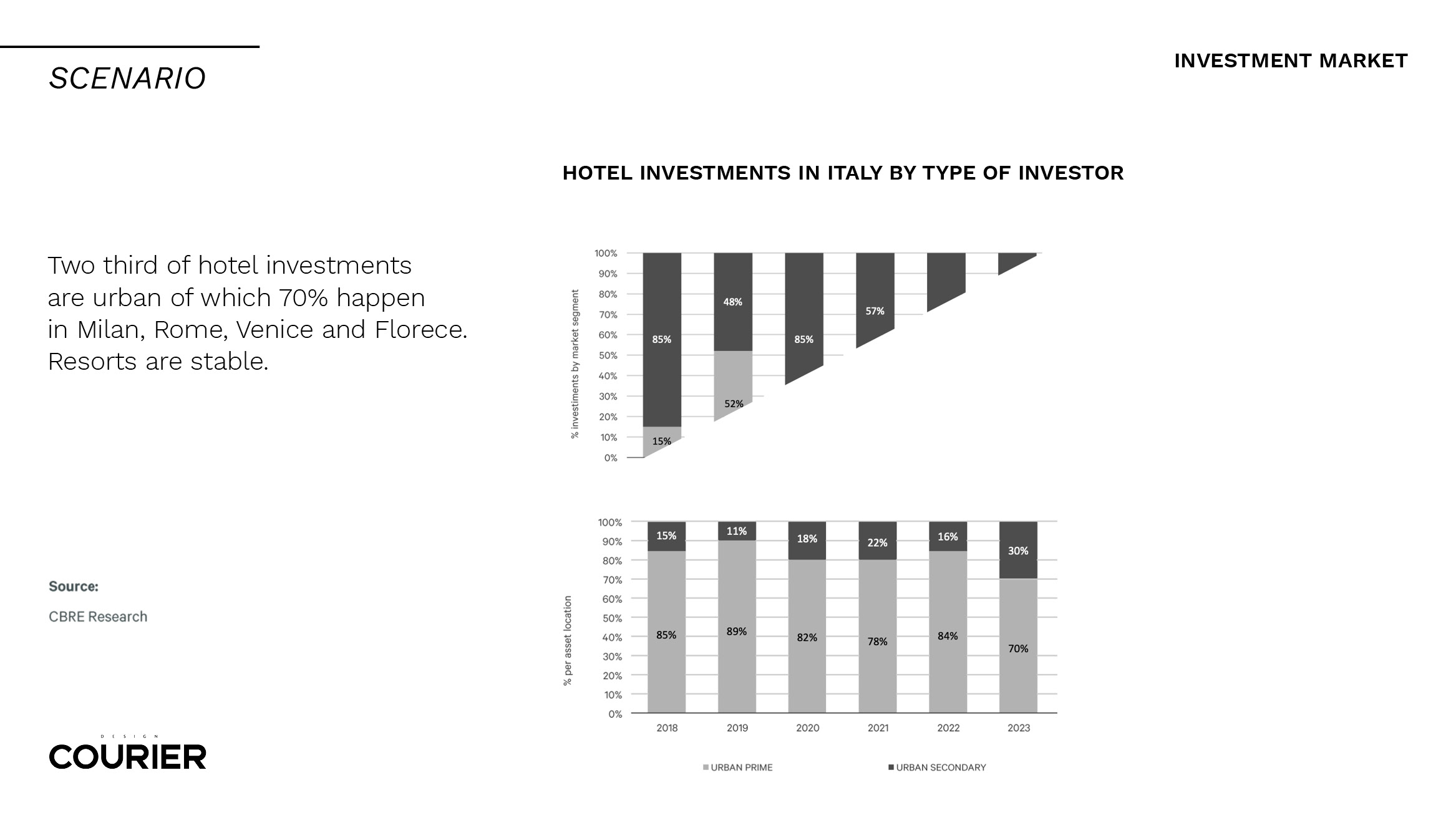

Who are the hotel investors in Italy? Looking at the investor types over the past few years, a significant portion is made up of value-add investors, classic private equity firms that buy existing hotels to renovate and rebrand where management is no longer effective. Thus, they add value to the asset to extract the maximum value. In the past year, there has also been a notable return of owner-operators, a category highly appreciated by hotel sellers because they maximize the purchase price for a long-term investment strategy. This has contributed to generating interesting liquidity from some managers and chains, who can now buy assets to later resell them and keep only the pure management.

Besides these figures, in the current debt market, the most active players remain the so-called full equity buyers, those who buy only with cash without needing immediate debt. These entities, like family offices, are central as they can easily beat on time institutional funds, which are slower and need financing.

Regarding the segmentation of the hospitality sector in Italy, about 70% of transactions occur in the four macro markets of Milan, Rome, Florence, and Venice. Therefore, those investing in hotels in Italy primarily do so in these metropolitan centers. The proportion of resorts versus urban hotels is stable, with resorts accounting for about a third of transactions. This segment was previously smaller, but in recent years it has created an interesting niche for growth.