| CANVAS OF PLANS & DRAWINGS |

INTERIOR & DÉCOR, but with a twist |

| HOTELS & RESTAURANTS, beyond mainstream |

Notes on ART |

| Into big AFFAIRS | INSIDERS |

| GLIMPSES | |

Keywords:

Hospitality vs Food, or rather, as Senior Director at CBRE Spain Roberto Sablayrolles prefers to call it, Hospitality plus Food. This was the theme of the last episode of the 2023 series Medelhan Talks for a Change. The hybridization of hospitality and the food world in high-level hotels is a phenomenon that is making its way more and more capillary in the sector, reflecting the evolution of guests’ expectations. The focus is on creating unique and memorable experiences for customers, both those hosted in the hotel, and external visitors. As Roberto Sablayrolles pointed out, Food & Beverage is increasingly leading the hospitality business, accounting for the 50% percent of the profit in some cases.

The F&B hospitality development path began in 1977, with the opening of Ian Schrager Studio 54’s New York club, at the crossroads of 7th and 8th Avenue, in Midtown Manhattan. From this moment a series of new openings have followed this model, guided by hospitality names such as Accor, Marriott and Hilton. Some of them imitated this type of product, others bought it, thus adding it to their portfolio. At the same time, other products not really belonging to the luxury segment, but still of an experiential nature, such as the Marriot’s Moxy brand or Hilton’s Curio, have entered the market. Finally, one more spectrum is that of star chefs, who more and more often develop brands themselves and start collaborations and partnerships with hotel chains, becoming part of their storytelling.

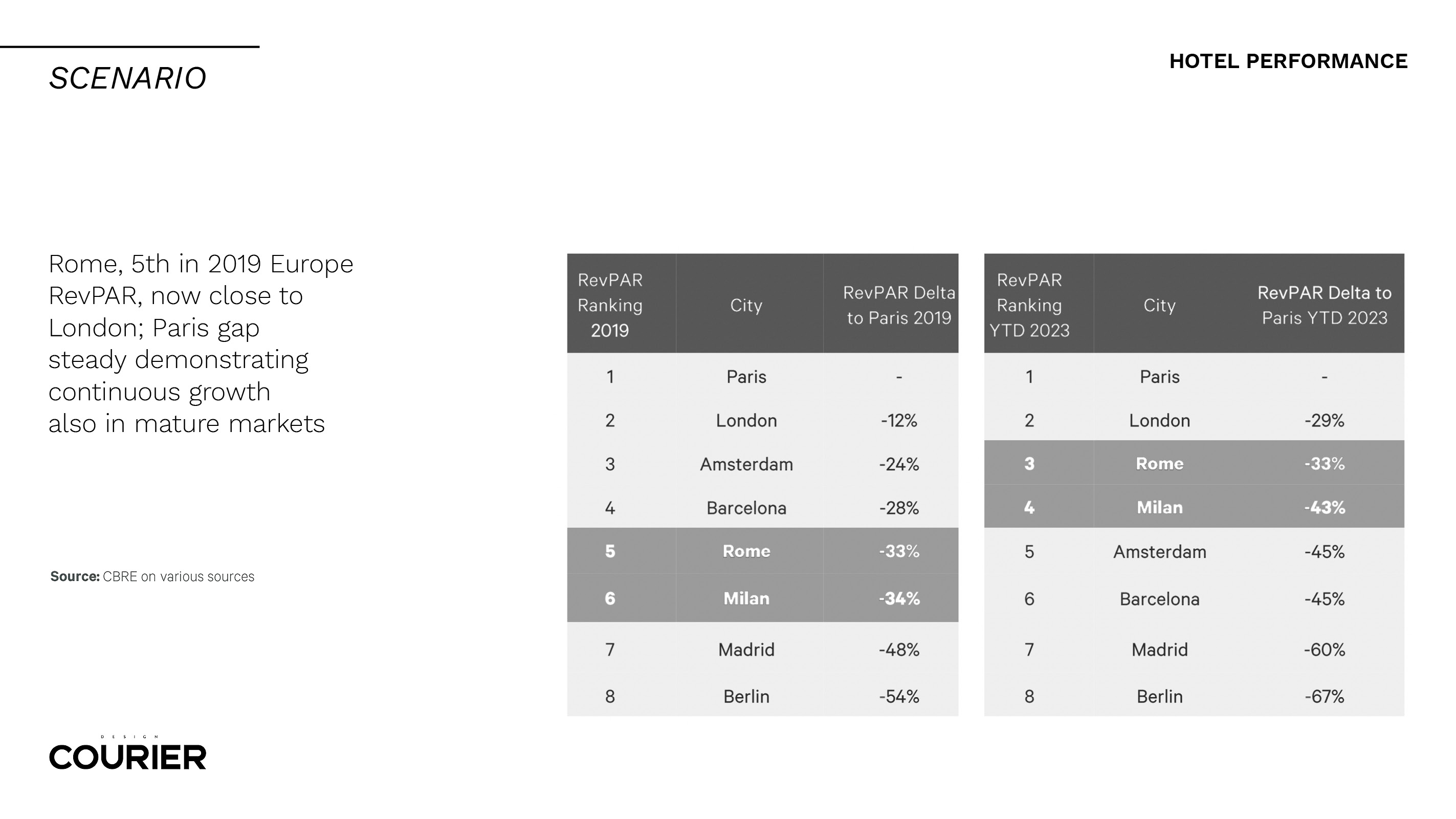

In terms of performance, Rome and Milan lead the group with important transactions. In RevPAR Rome passed Paris, followed by Milan and London. Madrid also recorded a good performance thanks to new luxury products coming to the city. At European level the positions of Milan and Rome remain very good, with continuous growth in the top markets.

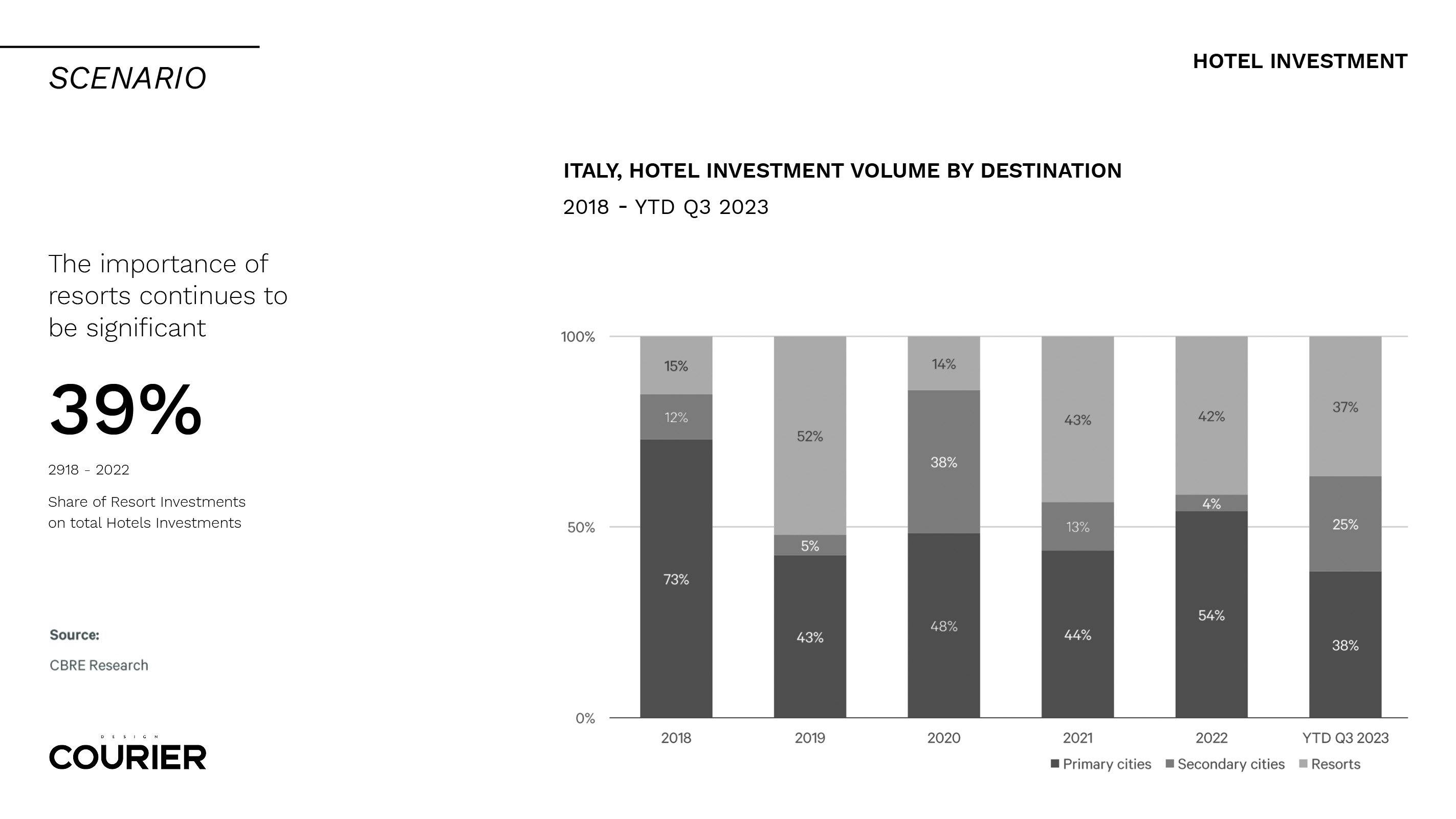

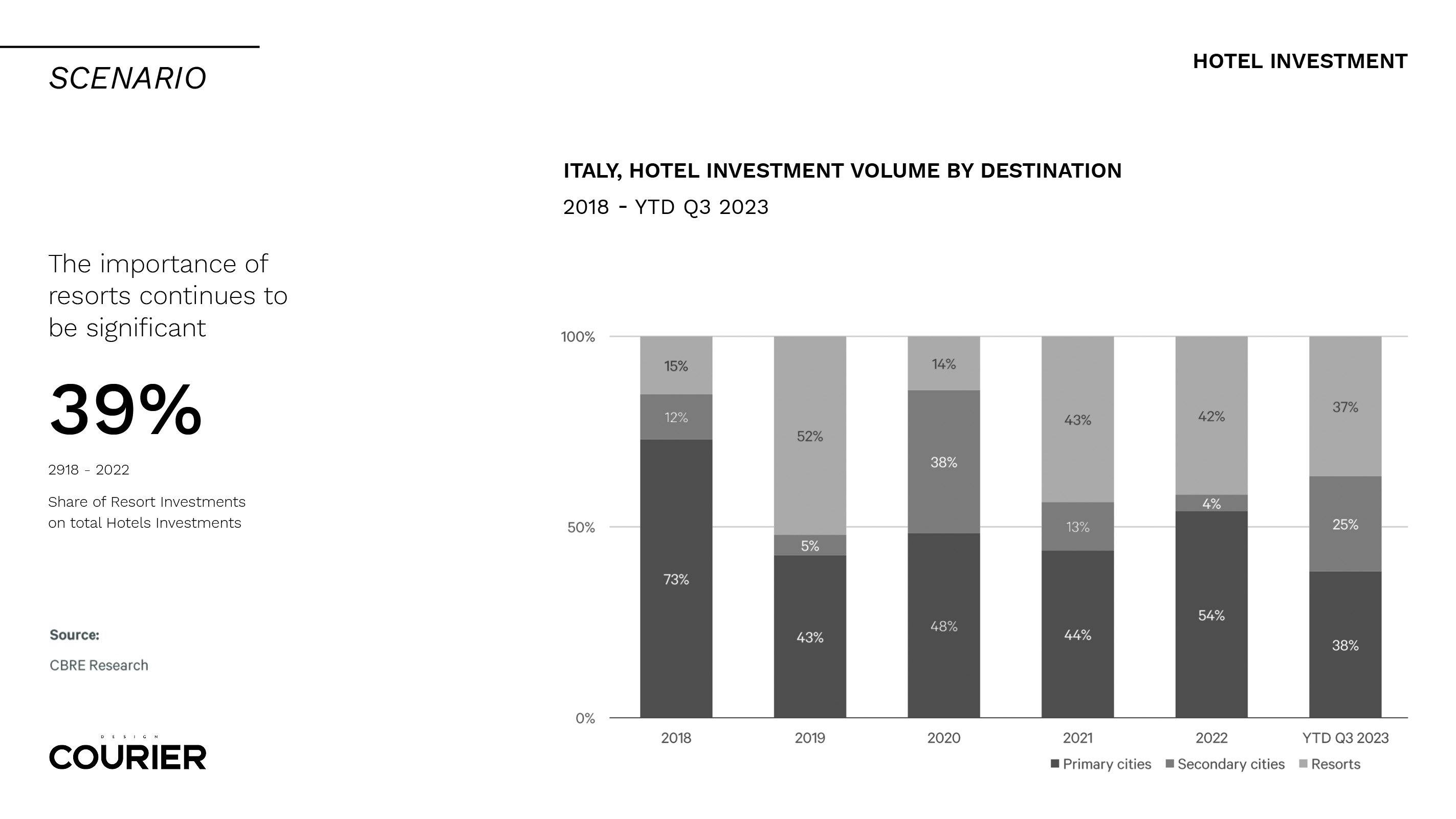

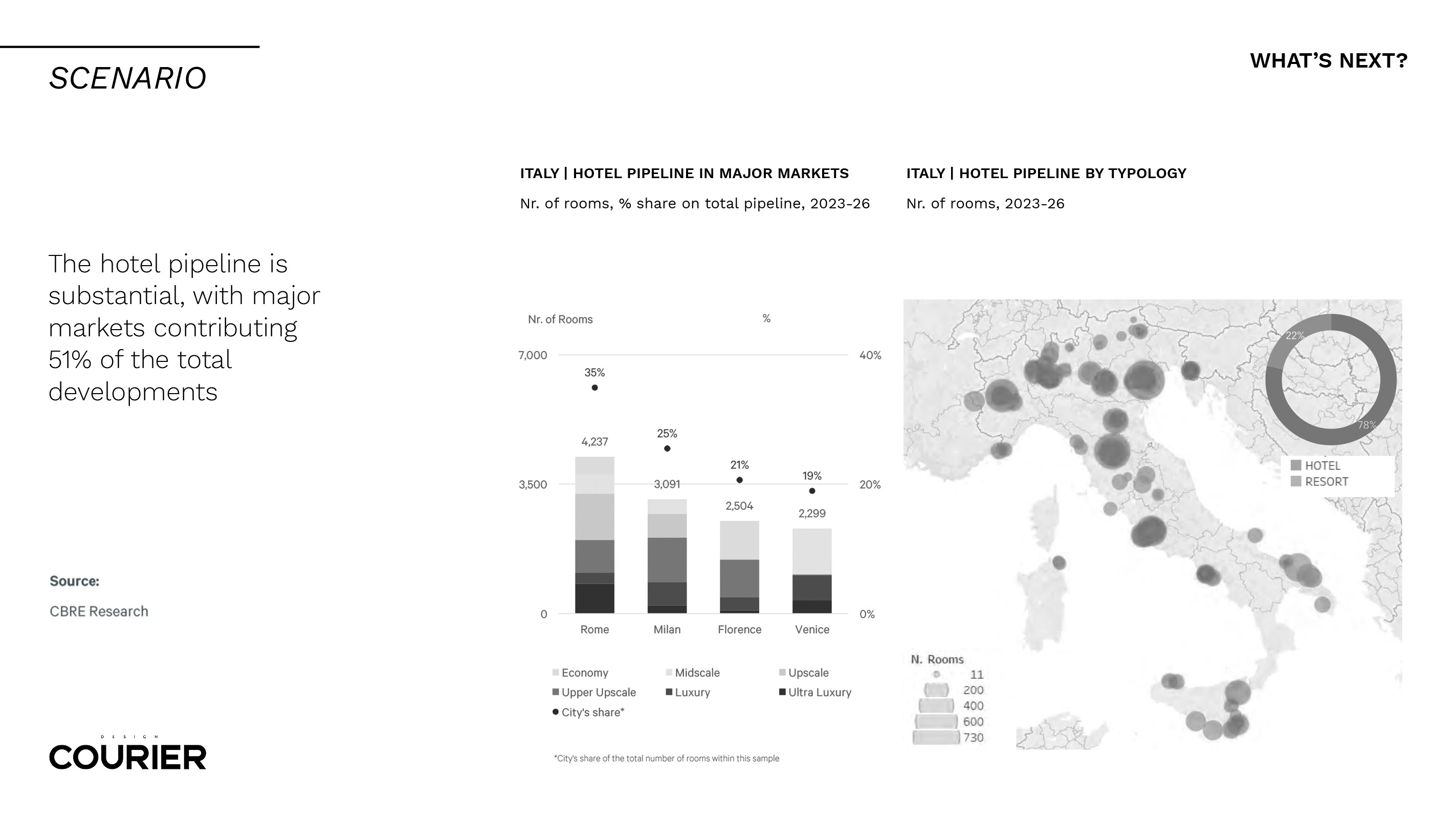

What’s next? The pipeline is strong and still in the hotel and resorts segment. Resorts will most likely account for +20 % in the market. We also see several projects coming in southern Italy, an area that we can define as growing. Finally, a note of merit to the city of Naples, where they are opening more and more new activities. The Parthenopean city, we can say, is returning to the international map, with more and more American tourists eager to discover it.