| CANVAS OF PLANS & DRAWINGS |

INTERIOR & DÉCOR, but with a twist |

| HOTELS & RESTAURANTS, beyond mainstream |

Notes on ART |

| Into big AFFAIRS | INSIDERS |

| GLIMPSES | |

Keywords:

Giordano Nicoletti is Senior Director at CBRE Hotels, a global leader in investment in Real Estate, with the ability and quality to follow the project throughout the whole life cycle. His last presentation for Talks for a Change, the Medelhan Media Production series, allows us to understand how the recovery that the tourism and hotel industry is recording translates into interest by investors.

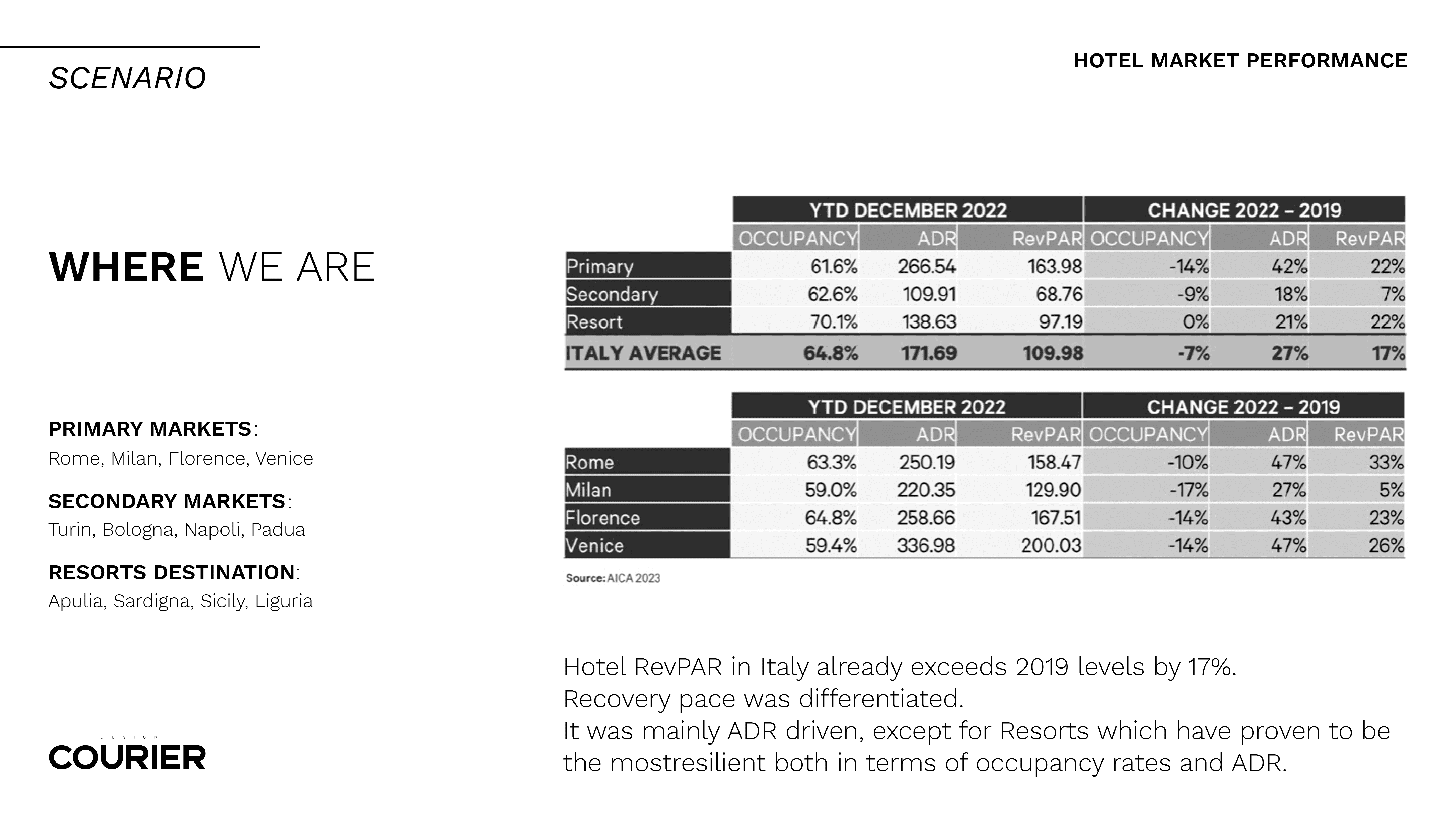

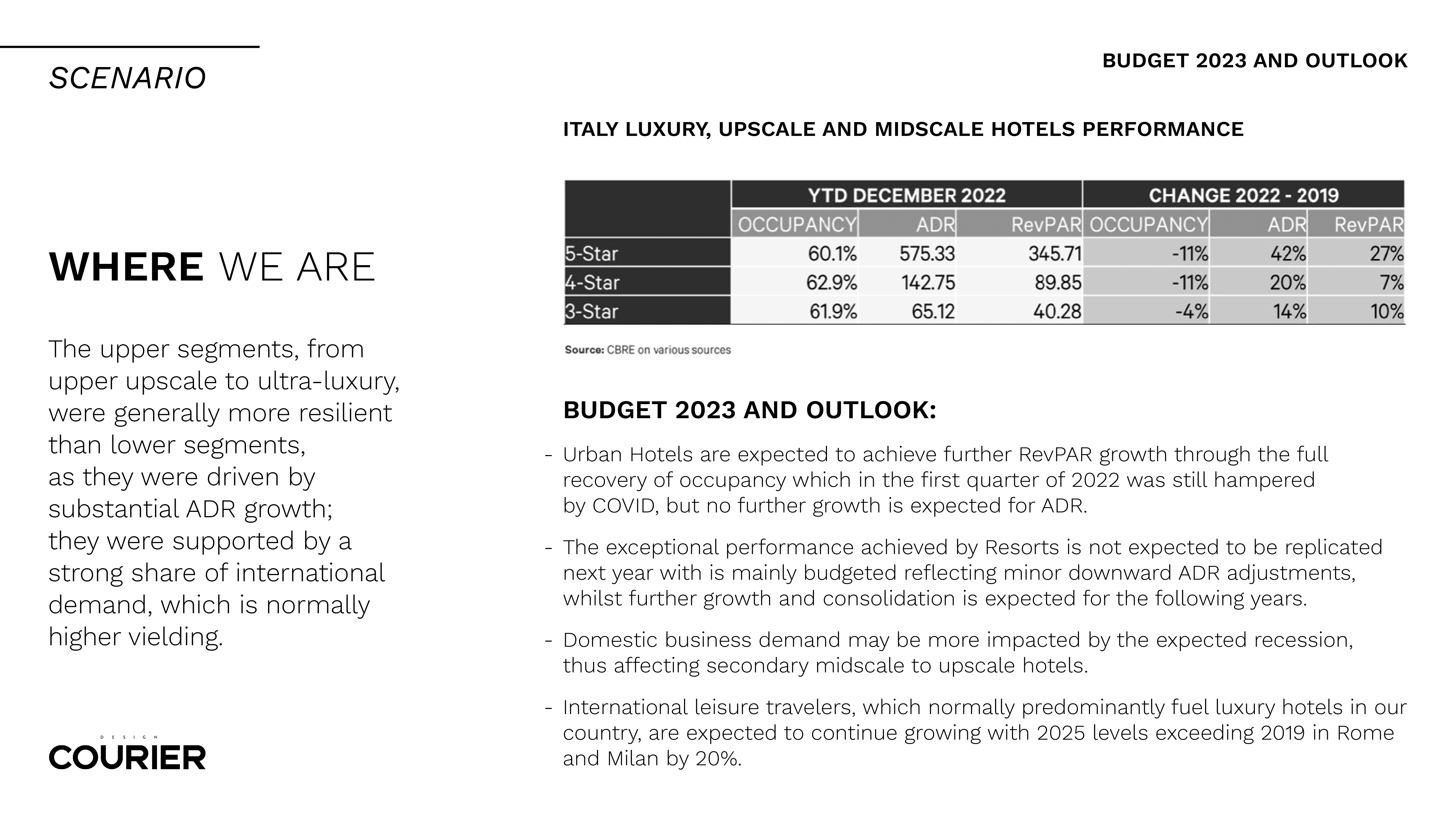

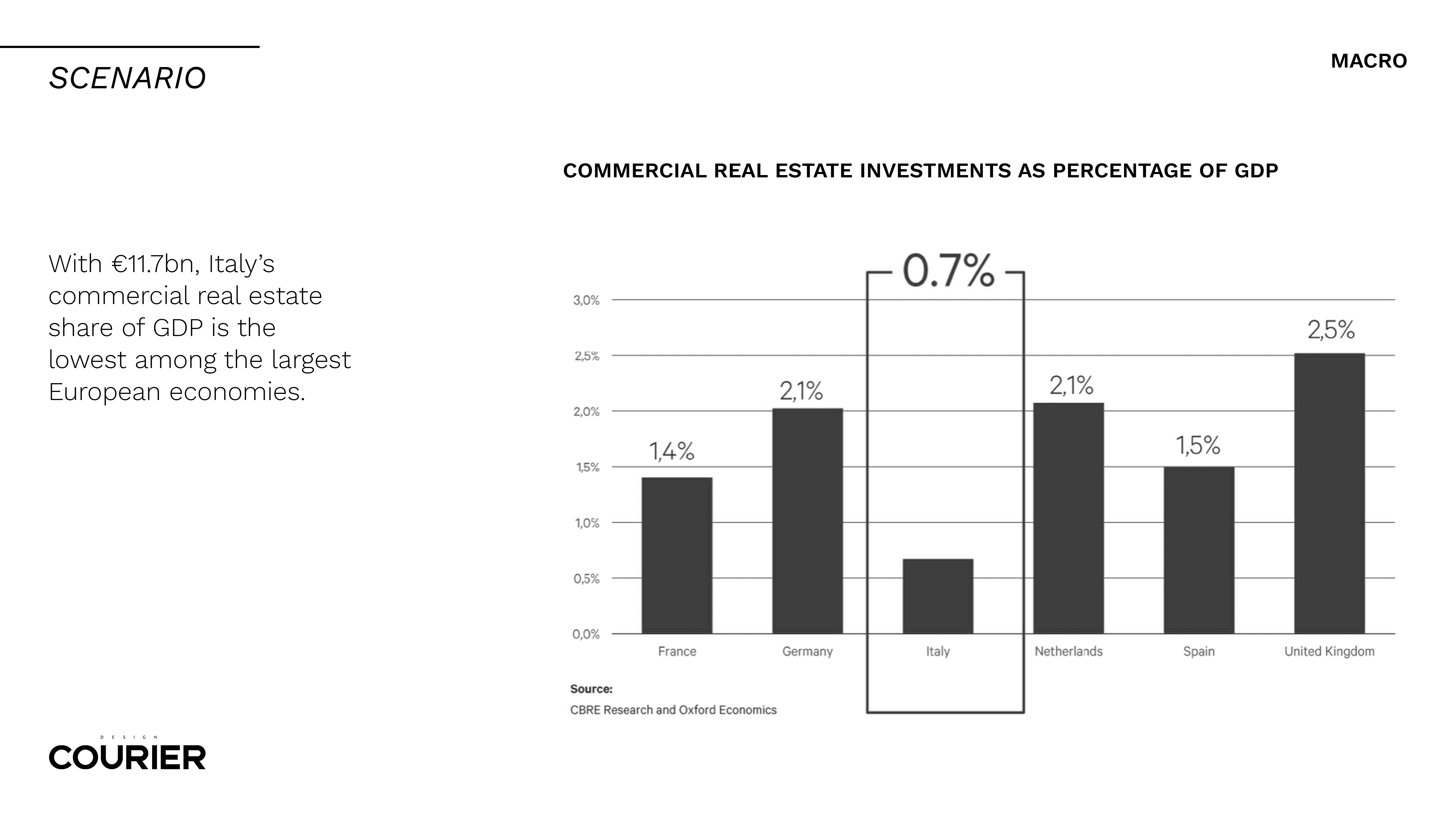

From a performance point of view, the Italian hotel industry has perhaps never experienced such a prosperous period. The numbers are higher than 2019, with fewer people and higher rates. Unfortunately, these performances are not converting in terms of investments in an equally positive way. Comparing the contribution to the gross domestic product of the six largest European economies, that is the impact that the Commercial Real Estate has on the total GDP, Italy is among the most visited countries in the world. Rome was the second European city after Paris to record the best performances in 2022. However, Commercial Real Estate in Italy is at 0.7%. Germany is surprisingly at 2.1%, a figure that covers the entire office and logistics market, which thanks to the strong local economy has a stimulus on this investment. If we look at the level of Italy, it is even below Holland, a smaller country with a much lower GDP.

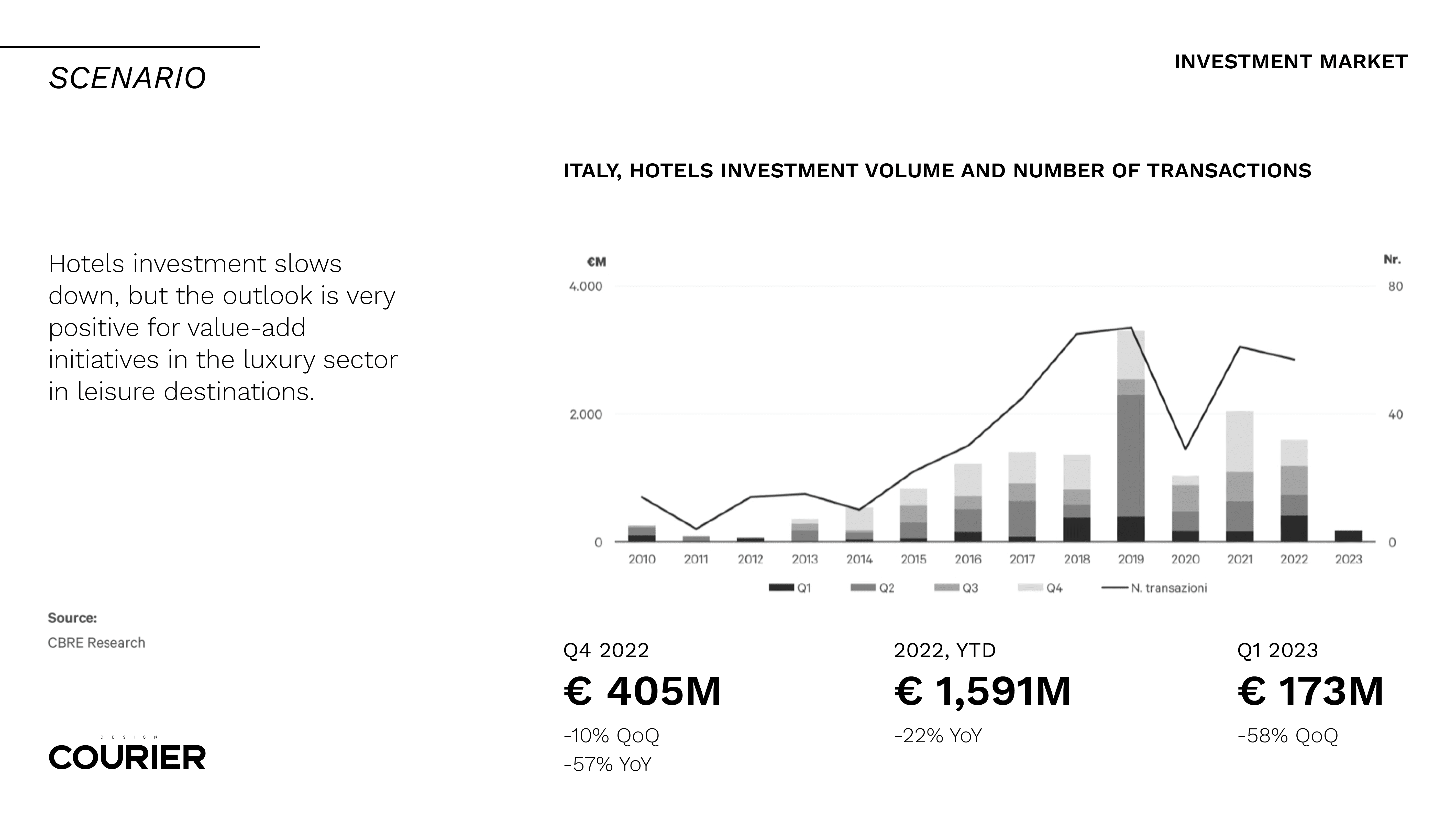

The Italian investment market had reached its peak in the second quarter of 2019 by virtue of the transaction of the Belmond hotels, purchased by the LVMH group. Compared to 2018, the two-year period 2020 2022 was also positive, with a 2021 that broke through the share of 2 billion investments. Thus, we were definitely in an important momentum. Given these premises, what happened in the last quarter of 2022? A geopolitical instability that has had consequences not only on the appetite of investors but especially on rates. If our economy has always been fundamentally financed at almost zero rate, today rates are 5 times higher. Here is the reason why the first quarter of 2023 was far below the expectations we had, based on the performance of the hotels available.

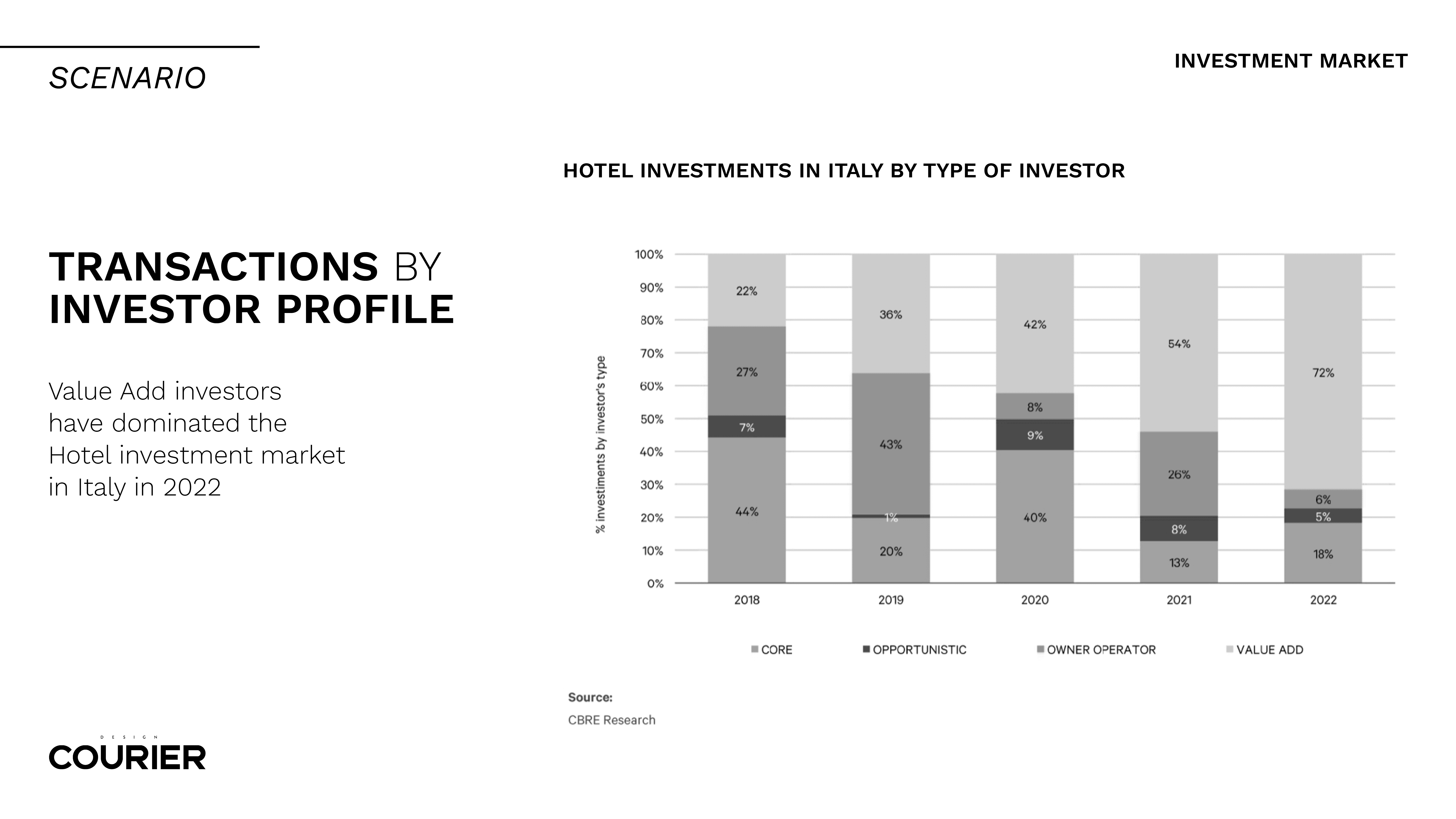

The type of investment that takes place in Italy is increasingly the so-called “value add”, that is the acquisition of properties originally intended for offices or three-four star hotels transformed into high-end structures. The value add investor is predominantly an institutional investor who creates a quality product because it positions itself better in the private sector. This is why we are seeing in Italy more products such as the Bulgari or the Six Senses Hotel in Rome, born of office conversions. The economic impact of a hotel on the territory and the immediate vicinity is in fact much higher than that of an office.

Another element that is believed will help push investments into the latter part of this year and the early 2024 is the greater balance in the management-property relationship. Fundamentally, there are three ways a hotel can be operated by a hospitality chain: a management contract – usually made by international chains – a rental contract – in which the operator takes over the walls and pays a fee – or a franchise contract – in which the hotel is inserted within the distribution channels but it remains managed by the hotel chain or by the entrepreneur himself. These contractual arrangements now see a better alignment between ownership and management than in previous years. Therefore, investors have more protection and control over the investment. This is the third factor that is believed will contribute to a significant recovery of hotel investment and therefore a restart of that acquisition, transformation and opening of new hotels cycle in Italy.